7 Reasons to Buy the Vanguard Value ETF If You Are Worried About a Stock Market Sell-Off

Vanguard offers dozens of equity exchange-traded funds (ETFs). Some of them, like the Vanguard S&P 500 Growth ETF, have outperformed the S&P 500 and Nasdaq Composite so far this year. But any Vanguard fund that doesn't own Nvidia has underperformed -- even top funds like the Vanguard Value ETF (NYSEMKT: VTV).

Here are seven reasons why this particular fund stands out as a top ETF to buy if you're worried about a stock market sell-off.

1. Effective diversification

The Vanguard Value ETF has 342 holdings, compared to 504 for the Vanguard S&P 500 ETF (NYSEMKT: VOO) and 188 for the Vanguard Growth ETF (NYSEMKT: VUG). But as you can see in the table, the Vanguard Value ETF is far less top heavy.

Vanguard Value ETF | Vanguard S&P 500 ETF | Vanguard Growth ETF | |||

|---|---|---|---|---|---|

Company | Weighting | Company | Weighting | Company | Weighting |

Broadcom | 3.6% | Microsoft | 7.2% | Microsoft | 13% |

Berkshire Hathaway | 3% | Nvidia | 6.6% | Apple | 12% |

JPMorgan Chase | 2.8% | Apple | 6.6% | Nvidia | 11.3% |

ExxonMobil | 2.5% | Alphabet | 4.3% | Alphabet | 7.5% |

UnitedHealth | 2.3% | Amazon | 3.9% | Amazon | 5% |

Procter & Gamble | 1.9% | Meta Platforms | 2% | Meta Platforms | 4.3% |

Johnson & Johnson | 1.7% | Berkshire Hathaway | 1.6% | Eli Lilly | 3% |

Home Depot | 1.7% | Eli Lilly | 1.6% | Tesla | 2.1% |

Merck | 1.5% | Broadcom | 1.5% | Visa | 1.6% |

AbbVie | 1.5% | JPMorgan Chase | 1.3% | Costco Wholesale | 1.5% |

Data source: Vanguard.

The Vanguard Value ETF has just 22.5% of its weighting in its top 10 holdings, far less than 36.6% for the Vanguard S&P 500 ETF and 61.3% for the Vanguard Growth ETF. Less emphasis on the largest holdings protects the fund from taking a major hit if a few key holdings drop. However, it can also hold the fund back if those megacap names put up outsized returns -- which is exactly what is driving such a strong year for the Vanguard Growth ETF.

Some downside risk protection can be achieved by having a diversified portfolio and not too much correlation to a particular theme or sector. The megacap tech-oriented names aren't perfectly correlated. But if Microsoft is down big, there's a good chance Amazon, Alphabet, and other names wouldn't be doing so great either -- which could compound into a volatile move in the Growth ETF.

2. Solid yield

The Vanguard Value ETF has a 2.3% yield, which is quite a bit higher than the 1.3% yield for the Vanguard S&P 500 ETF (NYSEMKT: VOO) or the 0.4% yield of the Vanguard Growth ETF (NYSEMKT: VUG).

A percentage point difference or two in yield doesn't look all that appealing when the major indexes are putting up massive returns. Rather, dividends show their true value when equity prices are falling. Collecting passive income without the need to sell stock can be a saving grace during a market downturn. It can provide added dry powder to reinvest in the market at attractive prices. Or it can help with financial planning.

Either way, the Vanguard Value ETF's higher yield relative to an S&P 500 fund or a growth-oriented fund is an advantage during a sell-off.

3. Low valuation

Many megacap growth stocks have seen their valuations increase due to their stock prices rising at a faster rate than earnings. Funds that don't own megacap names -- or own a lower weight than the S&P 500 -- stand a good chance of trading at a discount to the benchmark.

The Vanguard Value ETF has a 19.7 price-to-earnings (P/E) ratio, which is roughly half of the Vanguard Growth ETF and significantly lower than the 27.1 P/E ratio of the Vanguard S&P 500 ETF.

Valuations can get inflated during periods of investor optimism. But when there's a widespread sell-off, valuations can get put to the test when investors are less willing to pay a premium for potential growth and care more about where a business is today. Similarly, during skyrocketing bull markets, investors have a higher risk appetite and are willing to pay a premium for a business in the hopes it bridges the gap between expectations and reality.

No matter what the market is doing, investing in value stocks is a good choice for risk-averse investors, especially those who are more focused on capital preservation than capital appreciation.

4. Impressive past performance

Over the long term, innovation and technological breakthroughs can lead to explosive gains in the stock market. This is why growth stocks have a higher risk/potential return profile than value stocks. But that doesn't mean value stocks can't reward patient investors.

The Vanguard Value ETF has put up excellent returns, producing a total return of 16% over the past year, 29% over the past three years, 68% over the past five years, and 161% over the last decade. The fund invests in industry-leading companies -- many of which consistently grow their earnings, raise dividends, and repurchase stock.

In this vein, the Vanguard Value ETF rewards investors with a reliable stream of passive income and potential capital gains. This multifaceted approach starkly contrasts growth-focused ETFs, which pay very few dividends, so all the pressure is on the companies to become more valuable.

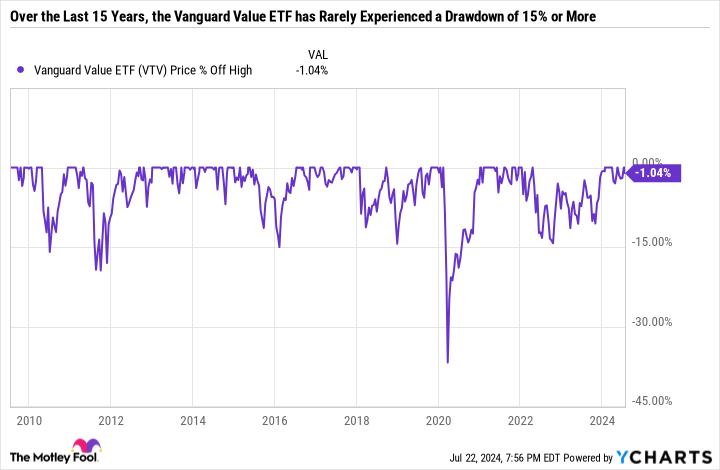

5. Resistance to sell-offs

A drawdown is a decline from an all-time high. A drawdown of 10% or more in a major index like the S&P 500 is known as a correction, and a drawdown of 20% or more is a bear market.

Over the last 15 years, the maximum drawdown the Vanguard Value ETF has ever experienced was 37% -- which occurred in 2020 due to the brutal market crash in March. For anyone following the market during that time, the sell-off was a true anomaly and largely a knee-jerk reaction to the COVID-19 pandemic. The losses were more than made up, and the market recovered by the end of the year.

Other notable sell-offs over the last 15 years include a 20% drawdown in summer 2011. There was also a 15% or so drawdown in late 2022. But in general, the Vanguard Value ETF has rarely fallen 15% or more from an all-time high.

Of course, no one knows where the market is headed. And what happened in the past isn't a crystal ball for what could happen in the future. But the Vanguard Value ETF's overall lack of volatility is reassuring, especially for risk-averse investors.

6. Low expense ratio

The lowest expense ratio of any Vanguard ETF is 0.03%. The Vanguard Value ETF is close behind at 0.04% -- or just $4 for every $10,000 invested. The ultra-low-cost profile of Vanguard's top funds is why they have among the highest net assets of any ETFs. With $168.5 billion in net assets, the Vanguard Value ETF is one of the largest U.S. equity value funds.

The fund also offers fractional shares. The minimum investment is just $1 -- much less than its $165 share price.

The combination of low cost and low entry level make the Vanguard Value ETF a convenient, inexpensive way to achieve diversification.

7. A plug-and-play investment vehicle

The six characteristics discussed so far all culminate in the Vanguard Value ETF's greatest quality: providing a passive, plug-and-play way to keep putting new capital to work in the market even when stock prices are crashing.

It's one thing to talk about investing through periods of volatility and steep sell-offs; it's another to endure it firsthand. It can be painful when a company you like loses a fourth of its value, and then another third on top of that. Zoom out, and it's a 50% sell-off. But it can feel so much worse if you keep buying the stock -- only to see it go lower and lower.

Investing requires a great deal of patience and grit. And sometimes, it can be far easier (emotionally and psychologically) to use ETFs as passive investment vehicles during a steep sell-off. ETFs are an excellent way to automate the decision-making process during a sell-off because you know you're getting diversification -- so there isn't the risk of a single position drastically impacting your financial health.

Having a game plan before a sell-off can help you filter out the noise and improve your decision-making when uncertainty and fear tighten their grip on the broader market.

Should you invest $1,000 in Vanguard Index Funds - Vanguard Value ETF right now?

Before you buy stock in Vanguard Index Funds - Vanguard Value ETF, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Vanguard Index Funds - Vanguard Value ETF wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $692,784!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of July 22, 2024

Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool's board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool's board of directors. JPMorgan Chase is an advertising partner of The Ascent, a Motley Fool company. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool's board of directors. Daniel Foelber has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Berkshire Hathaway, Costco Wholesale, Home Depot, JPMorgan Chase, Merck, Meta Platforms, Microsoft, Nvidia, Tesla, Vanguard Index Funds-Vanguard Growth ETF, Vanguard Index Funds-Vanguard Value ETF, and Vanguard S&P 500 ETF. The Motley Fool recommends Broadcom, Johnson & Johnson, and UnitedHealth Group and recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

7 Reasons to Buy the Vanguard Value ETF If You Are Worried About a Stock Market Sell-Off was originally published by The Motley Fool