This 7.7%-Yielding Sin Stock Just Increased Its Dividend Payment

Although the stock market has generally held up during the past couple of years, both the S&P 500 and Nasdaq Composite experienced some hefty selling during the past month. While sell-offs are par for the course in the market, they can be quite jarring for inexperienced investors.

One company that has been a consistent winner for decades is tobacco company Altria (NYSE: MO). Altria is considered to be a sin stock due to the products it sells -- primarily cigarettes.

Although investing in sin stocks may not be for everyone, I see a couple of encouraging reasons to give Altria a look. Let's explore why now could be a great opportunity to buy Altria shares.

Altria is an incredibly reliable source of passive income

Altria has earned a spot on an exclusive list known as the Dividend Kings -- a rarified class of companies that have increased dividend payments for at least 50 consecutive years.

Earlier this month, Altria told investors that its board approved a 4.1% increase to the company's quarterly dividend. Altria's quarterly dividend now sits at $1.02, or $4.08 per share on an annualized basis.

Most impressive, the new dividend hike is the 59th increase during the past 55 years.

With shares of Altria yielding close to 8%, it's tough to pass up this reliable source of passive income.

Why more gains could be in store

Altria is best known for its cigarette brands Marlboro and Black & Mild, as well as oral tobacco products like Skoal. However, during the past couple of years, Altria has made a concerted effort to pivot away from its legacy tobacco portfolio.

In particular, Altria is making significant investments in a category called smokeless tobacco. Smokeless tobacco includes products such as e-cigarette vapes and oral nicotine pouches.

According to Grand View Research, the total addressable market (TAM) in the U.S. for nicotine pouches was nearly $1 billion in 2023. Moreover, Grand View estimates the nicotine pouch market to grow at a compound annual growth rate (CAGR) of 33.6% between 2024 and 2030.

Beyond nicotine pouches, Altria has a huge opportunity in the e-cigarette and vaping market. Grand View Research estimates that the U.S. TAM for e-cigarettes and vaping products was valued at $28 billion in 2023 and is expected to grow at a 30.6% CAGR between 2023 and 2030.

Altria really made a splash in the vaping niche last year with its acquisition of NJOY. In roughly one year's time, Altria has expanded NJOY's footprint by threefold and is now in more than 100,000 stores.

I see the effort to penetrate the smokeless tobacco industry as a smart move for Altria. I think this represents an exciting new chapter for the company as Altria enters new and growing tobacco-adjacent opportunities.

Should you buy Altria stock right now?

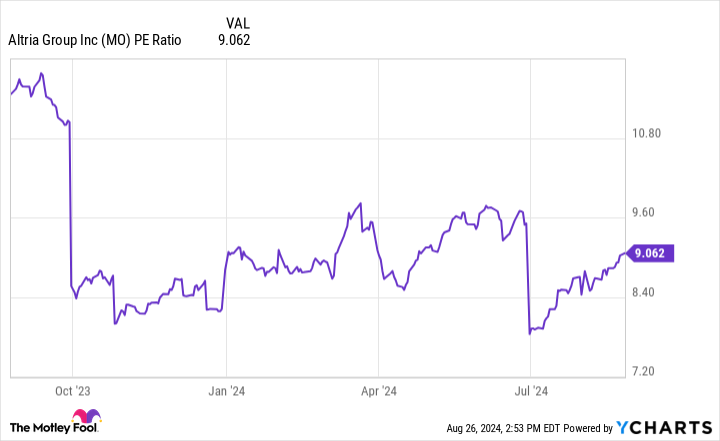

Altria currently trades at a price-to-earnings (P/E) ratio of about 9.1. By comparison, the P/E ratio of the S&P 500 is roughly 28. Clearly, investors are discounting Altria's growth prospects relative to the broader market.

However, given the themes explored above, I think investors are overlooking Altria's moves into emerging areas. Although traditional products such as cigarettes or chewing tobacco may be slowing or contracting businesses, Altria has wasted no time identifying new growth markets.

I see Altria as a potentially undervalued opportunity right now. Considering the markets for vaping and nicotine pouches are both expected to grow exponentially during the next several years, I think Altria will start to generate some newfound growth sooner rather than later.

Moreover, given its heavy discount to the broader market and nearly 8% dividend yield, it's hard for passive income and dividend investors, in particular, to pass up on Altria stock right now.

Should you invest $1,000 in Altria Group right now?

Before you buy stock in Altria Group, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Altria Group wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $769,685!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 26, 2024

Adam Spatacco has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

This 7.7%-Yielding Sin Stock Just Increased Its Dividend Payment was originally published by The Motley Fool