51 Annual Dividend Increases! Put This Stock on Your Wish List Now.

With 50 consecutive annual dividend increases a company earns the title Dividend King. Nucor (NYSE: NUE) has increased its dividend each year for 51 consecutive years. That alone should make this company of interest to a lot of investors, but there's one more factor that you need to understand -- Nucor operates in the highly cyclical steel industry. Here's why that's so important right now.

What does Nucor do?

Nucor makes steel and manufactures products from steel. It uses electric arc furnaces, which are more flexible than blast furnaces, and can be more easily ramped up and down along with demand. That has historically allowed Nucor to have attractive operating margins through the economic cycle.

This is notable because steel is an important industrial metal. It goes into everything from massive construction projects (think buildings, roads, and bridges) to cars and appliances. When times get tight, these long-lived, and highly expensive, investments often get put off. So demand for steel tends to be very cyclical, rising and falling along with economic activity. Although Nucor's steelmaking process does allow it to weather the steel market's ups and downs relatively well, it can't avoid those ups and downs. And when a recession hits, things can get pretty ugly pretty quickly.

This is why it is so impressive that Nucor has managed to earn the highly elite Dividend King title. Long-term investors can take comfort knowing that Nucor has continued to support, and grow, its dividend even when times are tough. But there's another not-so-small issue to consider here.

Timing is everything with Nucor

Given the company's status as a Dividend King it shouldn't be at all surprising that Nucor is a highly respected company. It is the kind of company that you buy and hold for decades, watching happily as it continues to expand its business over time. The big push right now, for example, is to increase the percentage of high-margin steel products that it sells (such as steel doors that are used in warehouses and the racks needed for data centers). This increases profitability and gives the company a way to use its own steel.

And yet you probably shouldn't buy Nucor when things are going well for the steel industry. That's when the stock price is likely to be most dear and the stock least attractive. Given the economic sensitivity, you'll probably be better off putting Nucor on your wish list for a time when the steel industry is struggling. You might want to add Nucor to your wish list right now.

For starters, Nucor is coming off a couple of incredibly strong years. Second, the company is again dealing with material imports that have put downward pressure on steel prices. So there's a high bar and increasing industry headwinds, which is why second-quarter 2024 earnings came in $2.68 per share, down from $3.46 in the first quarter of the year and $5.81 in the second quarter of 2023. The company said investors should expect an even lower earnings figure in the third quarter of 2024 as steel prices continue to fall. Simply put, it looks like a downturn in the steel industry could be getting underway, exacerbated by a flood of imports.

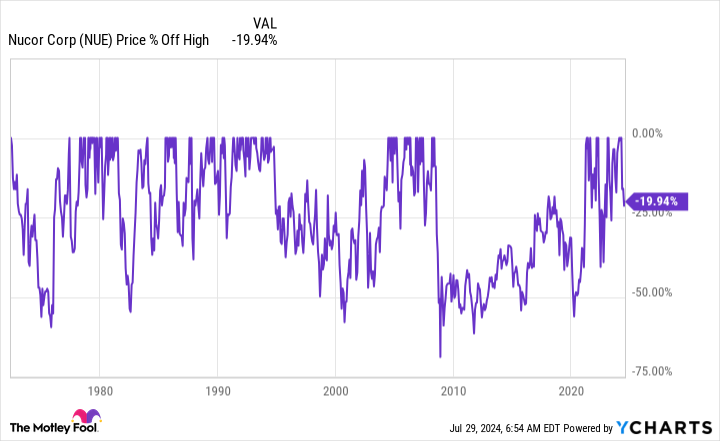

The stock is off nearly 20% from its recent high-water mark. But that's not as deep a drawdown as it might sound, given that 40% to 60% isn't uncommon here. However, the current price decline coupled with the earnings results hints that this Dividend King could be getting to the point where a long-term investor would be interested. Now is the time to do your homework on Nucor so you'll be prepared to step in and buy it when things look the most bleak.

It takes guts to buy Nucor

Cyclical stocks can be tough to own because their financial performance, and often their stock prices, can swing dramatically. But that's also an opportunity if you are willing to step in and buy when others are fearful. If you focus on the industry leaders, like Dividend King Nucor, you are likely to increase your chances of long-term investment success. It looks like Nucor should be on your wish list today given its weakening results and the increasing competition in the steel industry. Do the research now so you will have the wherewithal to buy when a deep stock price decline and terrible industry fundamentals are telling your gut to stay away.

Should you invest $1,000 in Nucor right now?

Before you buy stock in Nucor, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nucor wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $657,306!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of July 29, 2024

Reuben Gregg Brewer has positions in Nucor. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

51 Annual Dividend Increases! Put This Stock on Your Wish List Now. was originally published by The Motley Fool