5 Financial Transaction Stocks to Watch Amid an Expanding Digital Era

The Financial Transaction Services industry is poised to benefit from the widespread adoption of digital payment methods. Industry players are positioned to capitalize on this trend through robust digital solutions devised by strategic collaborations and technology investments. Favorable consumer spending patterns are expected to increase transaction volumes. Additionally, the rise in cross-border transactions, fueled by a growing international workforce and expanding global trade, contributes positively. Expected interest rate cuts in 2024 could spur a revival in merger and acquisition (M&A) activity. Companies like Visa Inc. V, Mastercard Incorporated MA, Fiserv, Inc. FI, Fidelity National Information Services, Inc. FIS and Global Payments Inc. GPN are well-positioned to benefit from the industry's promising growth prospects.

About the Industry

The Zacks Financial Transaction Services industry is part of the Financial Technology or the FinTech space, including companies with diverse natures of businesses. The industry comprises card and payment processing and other solutions providers, ATM services and money remittance service providers and providers of investment solutions to financial advisors. The players in this segment operate their unique and proprietary global payments network that links issuers and acquirers around the globe to facilitate the switching of transactions, permitting account holders to use their products at millions of acceptance locations. Monetary transactions are effectuated through these networks, offering a convenient, quick and secure payment method in several currencies across the globe. The industry is benefiting from the ongoing digitization movement triggered by the pandemic.

4 Trends Influencing the Financial Transaction Services Industry's Future

A Booming Digital Era: The global shift toward contactless payments continues to accelerate, with cash and checks becoming less common. In response, industry players are introducing a range of innovative payment options, including cryptocurrency, biometrics, QR codes and buy now, pay later solutions. These advancements have broadened the customer base and diversified revenue streams, offering enhanced convenience and value. To stay competitive and sustain market leadership, companies are making substantial investments in technology. However, the growing adoption of digital payments also increases the risk of sophisticated cybercrimes, which can lead to significant losses and data breaches for both consumers and businesses. As a result, industry players are prioritizing the development of secure payment solutions and heavily investing in robust fraud prevention strategies.

Robust Cross-Border Volumes: Financial transaction services companies with substantial cross-border business stand to gain from the rise in international trade, growing travel activity, and the persistent demand for efficient remittance services. Companies that provide sophisticated cross-border payment solutions are particularly appealing, as they enable seamless global transactions and handle currency exchange effectively. These solutions are essential for businesses to receive payments from international customers and make timely payments to suppliers, ensuring uninterrupted operations. The expanding global workforce continues to fuel the need for reliable cross-border remittance services.

Resilient Consumer Spending: The rise in consumer spending reflects greater usage of products and services offered by industry players. This uptick in spending is driving higher transaction volumes and, in turn, boosting revenues. According to a report from Deloitte's Global Economics Research Center, consumer spending is projected to grow 2.4% in 2024 in the U.S. economy, up from the 2.2% growth recorded last year. A robust e-commerce landscape, driven by increased Internet penetration and higher usage of smartphones, is expected to sustain favorable levels of consumer spending in the near term. However, inflationary pressures may pose a challenge by potentially constraining consumers' purchasing power.

Inorganic Growth Strategies: To build a comprehensive suite of digital solutions, companies in the Financial Transaction Services sector frequently engage in mergers and acquisitions (M&A) alongside their technology investments. These strategies are crucial for enhancing capabilities, gaining diversification benefits, expanding the customer base and strengthening global presence. The Federal Reserve decided to trim interest rates by 50 basis points in its latest policy meeting. As cited by multiple sources, further rate cuts are likely to take place this year. This, in turn, may encourage more companies to pursue loans for M&A deals, allowing them to preserve cash reserves.

Zacks Industry Rank Instills Optimism

The group’s Zacks Industry Rank, which is the average of the Zacks Rank of all member stocks, indicates bright near-term prospects. The Zacks Financial Transaction Services industry is housed within the broader Zacks Business Services sector. It currently carries a Zacks Industry Rank #64, which places it in the top 25% of more than 250 Zacks industries.

Our research shows that the top 50% of the Zacks-ranked industries outperform the bottom 50% by a factor of more than two to one. The industry’s positioning in the top 50% of the Zacks-ranked industries is a result of a negative earnings outlook for the constituent companies in aggregate.

Before we present a few stocks that you may want to buy or retain in your portfolio, let’s take a look at the industry’s recent stock-market performance and valuation picture.

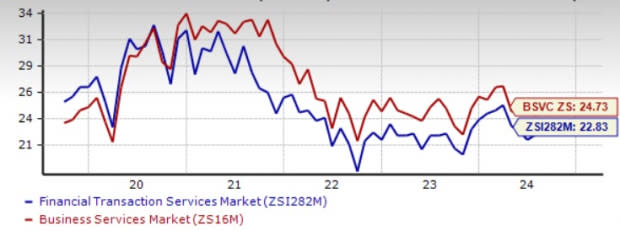

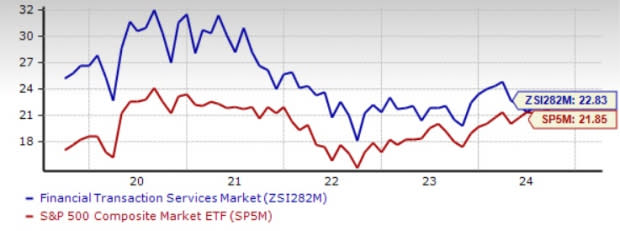

Industry Underperforms Sector, S&P 500

The Zacks Financial Transaction Services industry underperformed its sector and the Zacks S&P 500 composite in the past year.

In the said time frame, the industry has gained 25.5% compared with the Business Services sector’s growth of 29.9%. The S&P 500 has rallied 33.5% in the same time frame.

One-Year Price Performance

Image Source: Zacks Investment Research

Industry's Current Valuation

On the basis of the forward 12-month Price/Earnings ratio, commonly used for valuing financial transaction services stocks, the industry is currently trading at 22.83X compared with the S&P 500’s 21.85X and the sector’s 24.73X.

In the past five years, the industry traded as high as 32.49X, as low as 18.57X and at the median of 24.22X.

Forward 12-Month Price/Earnings (P/E) Ratio

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

5 Stocks to Keep a Close Eye on

We are presenting five stocks from the Financial Transaction Services industry that currently carry a Zacks Rank #2 (Buy) or Zacks Rank #3 (Hold). Considering the current industry scenario, it might be prudent for investors to buy or retain these stocks in their portfolio, as these are well-placed to generate growth in the long haul.

Visa: Headquartered in San Francisco, the company is a global leader in digital payments. It actively expands its network by entering new agreements, renewing partnerships, and pursuing strategic acquisitions. Robust operations in Latin America, Canada and the United States drive growth for this Zacks Rank #2 company. Strong consumer spending boosts transaction processing fees, leading to higher revenues for Visa. The company places significant emphasis on technology investments to enhance its advanced digital offerings. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

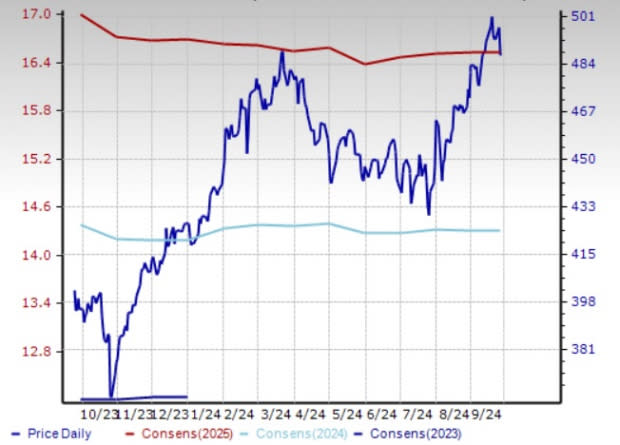

The Zacks Consensus Estimate for Visa’s fiscal 2024 earnings is pegged at $9.92 per share, indicating a 13.1% rise from the year-ago reported figure. V’s earnings beat estimates in each of the last four quarters, the average beat being 2.90%.

Price and Consensus: V

Image Source: Zacks Investment Research

Fidelity National: Based in Jacksonville, FL, Fidelity National is seeing revenue growth fueled by strong performances in its Banking Solutions and Capital Market Solutions segments. The Banking unit benefits from new client acquisitions, while the Capital Market segment is experiencing robust sales growth, leading to higher recurring revenues. This Zacks Rank #2 company leverages organic growth strategies and acquisitions to secure multi-year recurring contracts.

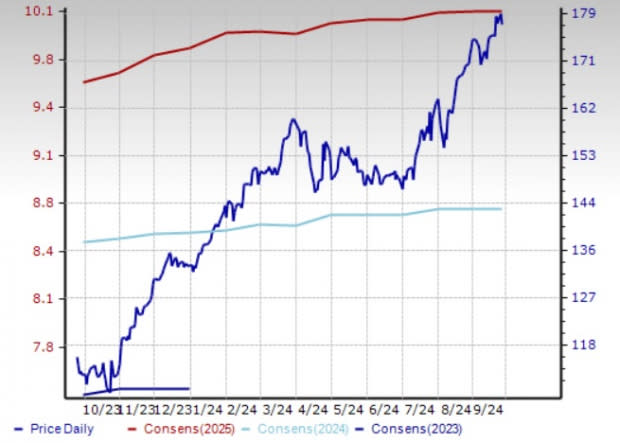

The Zacks Consensus Estimate for Fidelity National’s 2024 earnings is pegged at $5.08 per share, calling for an improvement of 50.7% from the year-ago reported figure. The consensus mark for 2024 earnings has moved 0.6% north in the past 30 days.

Price and Consensus: FIS

Image Source: Zacks Investment Research

Mastercard: Based in Purchase, NY, the company consistently partners with financial institutions and makes substantial investments to secure a prominent position in the global payments market. The Mastercard Cross-Border Services platform enables customers to conduct secure cross-border money transfers. Acquisitions have strengthened the capabilities of this Zacks Rank #3 company.

The Zacks Consensus Estimate for Mastercard’s 2024 earnings is pegged at $14.29 per share, indicating a 16.6% rise from the year-ago reported figure. MA’s earnings beat estimates in each of the last four quarters, the average being 3.49%.

Price and Consensus: MA

Image Source: Zacks Investment Research

Fiserv: Fiserv, headquartered in Wisconsin, offers a diverse range of products and services, including payment processing, core banking systems and digital banking solutions. Its business model leverages the advantages of recurring revenues and high incremental margins from its scaled processing operations. This Zacks Rank #3 company aims to outperform through new client acquisitions and deepening relationships with existing clients.

The Zacks Consensus Estimate for Fiserv’s 2024 earnings is pegged at $8.74 per share, indicating a 16.2% rise from the year-ago reported figure. FI’s earnings beat estimates in each of the last four quarters, the average being 2.75%.

Price and Consensus: FI

Image Source: Zacks Investment Research

Global Payments: Headquartered in Atlanta, GA, Global Payments is well-positioned for growth, supported by strong performances in its Merchant Solutions and Issuer Solutions segments. The Merchant Solutions unit is set to benefit from rising transaction volumes. Meanwhile, the Issuer Solutions segment is expected to gain from growth in core issuers. This Zacks Rank #3 company has pursued acquisitions and partnerships to enhance its capabilities and expand its geographic reach.

The Zacks Consensus Estimate for Global Payments’ 2024 earnings is pegged at $11.63 per share, indicating an 11.6% rise from the year-ago figure. GPN’s earnings beat estimates in each of the last four quarters, the average being 0.93%.

Price and Consensus: GPN

Image Source: Zacks Investment Research

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Visa Inc. (V) : Free Stock Analysis Report

Mastercard Incorporated (MA) : Free Stock Analysis Report

Fidelity National Information Services, Inc. (FIS) : Free Stock Analysis Report

Global Payments Inc. (GPN) : Free Stock Analysis Report

Fiserv, Inc. (FI) : Free Stock Analysis Report