$5,000 in This Vanguard ETF Incurs a Mere $4 Annual Fee, and It Has Beaten the S&P 500 and Nasdaq Composite in 2024

Exchange-traded funds (ETFs) can be excellent passive income vehicles, especially when they are low-cost. Consider the Vanguard Russell 1000 Growth ETF (NASDAQ: VONG). Its expense ratio is a mere 0.08%, meaning that $5,000 invested in the fund would result in just $4 in fees per year.

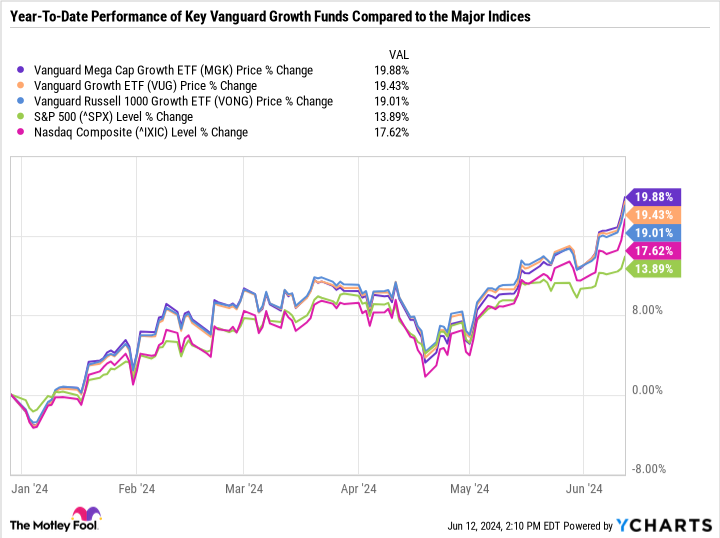

The ETF hit an all-time high on Wednesday in lockstep with a broader market rally. It has been one of Vanguard's best-performing funds so far this year, up a blistering 19.3% compared to a 17.7% return for the Nasdaq Composite and 14% for the S&P 500.

Here's a primer on the exchange-traded fund and why it could be worth buying now.

Broad-based exposure through a growth lens

The Russell 1000 is a market-cap-weighted index that includes the 1,000 largest U.S. companies. Given the top-heavy nature of the market, the Russell 1000 encompasses about 93% of the total market cap of U.S. equities.

The Vanguard Russell 1000 Growth ETF essentially takes this pool of candidates and narrows it down to the most growth-oriented companies. It includes 440 stocks, so less than half of the Russell 1000. Here's a look at the sector breakdown of the Vanguard Russell 1000 Growth ETF compared to the Vanguard Russell 1000 ETF (NASDAQ: VONE).

Sector | Vanguard Russell 1000 Growth ETF | Vanguard Russell 1000 ETF |

|---|---|---|

Technology | 53.4% | 32.8% |

Consumer discretionary | 18.8% | 14.1% |

Healthcare | 10.2% | 11.7% |

Industrials | 9.7% | 12.9% |

Consumer staples | 2.6% | 4.8% |

Financials | 2.5% | 10.8% |

Real estate | 0.8% | 2.4% |

Telecommunications | 0.6% | 2% |

Energy | 0.6% | 4.1% |

Basic materials | 0.4% | 1.8% |

Utilities | 0.4% | 2.6% |

Data source: Vanguard.

As you can see in the table, the Vanguard Russell 1000 Growth ETF has significantly lower weightings in value-focused sectors like financials. Over 70% of the fund is concentrated in technology and consumer discretionary compared to less than 50% for the Russell 1000.

Other Vanguard growth funds to consider

The Vanguard Russell 1000 Growth ETF closely resembles Vanguard's largest growth fund by net assets -- the Vanguard Growth ETF (NYSEMKT: VUG). The Vanguard Growth ETF essentially picks the most growth-oriented companies from the S&P 500. So, a similar approach to the Vanguard Russell 1000 Growth ETF -- just more concentrated in the largest companies.

It includes 200 components and a slightly lower expense ratio of 0.04% compared to 0.08% for the Vanguard Russell 1000 Growth ETF. The difference is minor unless you invested hundreds of thousands of dollars in these funds.

Ultimately, the best Vanguard growth fund for you depends on your desired concentration in the largest companies versus diversifying into a larger pool of choices. For example, there's also the Vanguard Mega Cap Growth ETF (NYSEMKT: MGK) -- which has just 79 holdings and is even more focused on the most valuable U.S. growth stocks by market capitalization. But as you can see in the chart, the Vanguard Russell 1000 Growth ETF, Vanguard Growth ETF, and Vanguard Mega Cap Growth ETF have all performed similarly this year.

A worthy passive income play if you can stomach the volatility

The dominant trend of 2024 has been megacap growth, so it makes sense why growth-oriented funds -- and especially those concentrated in the largest market-cap companies -- are outperforming the S&P 500 and Nasdaq Composite.

However, the best use of a low-cost ETF isn't to try and time the market by whatever is working in the short term, but rather to find a passive income vehicle that you like and feel comfortable holding through periods of volatility.

Growth stocks are usually more volatile than value and income stocks. Growth ETFs achieve diversification, but it's worth understanding they could also fall more than the major benchmarks during a correction or a major stock market sell-off.

All three of the Vanguard ETFs discussed are good choices, but the Vanguard Russell 1000 Growth ETF could be the best choice if you want exposure to more companies and slightly less concentration in the largest names.

Should you invest $1,000 in Vanguard Scottsdale Funds - Vanguard Russell 1000 Growth ETF right now?

Before you buy stock in Vanguard Scottsdale Funds - Vanguard Russell 1000 Growth ETF, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Vanguard Scottsdale Funds - Vanguard Russell 1000 Growth ETF wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $808,105!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of June 10, 2024

Daniel Foelber has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Vanguard Index Funds-Vanguard Growth ETF. The Motley Fool has a disclosure policy.

$5,000 in This Vanguard ETF Incurs a Mere $4 Annual Fee, and It Has Beaten the S&P 500 and Nasdaq Composite in 2024 was originally published by The Motley Fool