2 Trillion-Dollar Stocks I'm Buying Hand Over Fist

Some investors may be averse to buying stocks that are already above a trillion-dollar valuation, but this is a mistake. While the law of large numbers dictates that growth will be harder the larger you get, nearly all trillion-dollar companies have taken exception to that rule due to their dominance.

Investors should look to invest in the most dominant companies in the world, as these are the ones that will drive long-term returns. Two trillion-dollar stocks that I think are fantastic investments right now are Amazon (NASDAQ: AMZN) and Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL). Both companies are dominant in their respective niches yet still have more room for improvement, which means higher return potential.

Amazon

Amazon has been one of the most innovative companies in the world over the past two decades. The way it has transformed how people shop is nothing short of incredible. If you surveyed the average person about services they couldn't live without, Amazon Prime and its fast shipping would likely be atop that list.

But Amazon isn't just about commerce. It's also been an innovator in the cloud computing space. Amazon Web Services (AWS) is the largest cloud computing provider by market share and is fundamental to modern computing. Even in the age of the artificial intelligence (AI) arms race, AWS is still highly relevant, as anyone looking to create an AI model needs serious computing power, which is conveniently available for rent from AWS.

From a financial perspective, Amazon is reaching unexplored levels. While Amazon continues to post solid growth (revenue rose 13% year over year in the first quarter), its margins have the most room for improvement. Thanks to CEO Andy Jassy's renewed focus on efficiency, Amazon's operating margins in all segments have improved dramatically in just one year.

Segment | Q1 FY 2023 Operating Margin | Q1 FY 2024 Operating Margin |

|---|---|---|

North America | 1.2% | 5.8% |

International | (4.3%) | 2.8% |

AWS | 24% | 37.7% |

Data source: Amazon.

That improvement has helped the company's profitability, although, according to Jassy, there is still room for improvement.

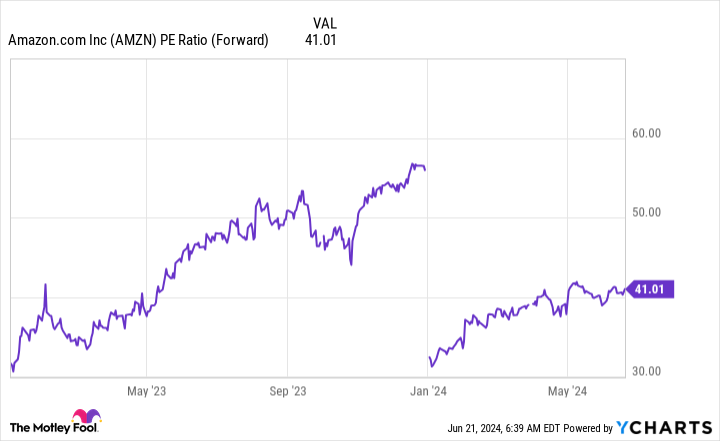

The stock market is also pricing in this improvement, as the stock trades at a pricey 41 times forward earnings.

As Amazon grows and its margins improve, this premium will continue to decrease. There's too much good going on with the company to ignore it, so investors should scoop up shares when they can.

Alphabet

With its Google search engine and YouTube platform, Alphabet is highly exposed to advertising. In Q1, 77% of revenue came from advertising, so ensuring its platform is the best in the business is critical.

Alphabet has long been a leader in this field, and its latest rollout of AI tools powered by its generative AI model, Gemini, has only solidified that. When you search on Google, an AI-created summary appears at the top of the search results, which is useful in many instances. Alphabet also empowers advertisers by giving them tools to create a successful ad campaign easily.

Similar to Amazon, Google Cloud's division competes in the same market but has a particular focus on AI tools. That's why 60% of funded generative AI start-ups and 90% of generative AI unicorns (private companies worth more than $1 billion) have chosen Google Cloud.

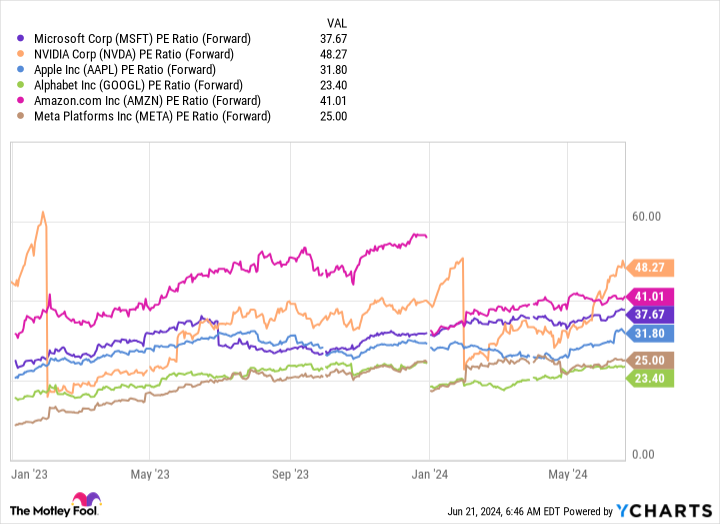

While Alphabet's financials are rock solid, its stock is much cheaper than many of its trillion-dollar peers' from a forward price-to-earnings (P/E) standpoint.

At 23.4 times forward earnings, Alphabet barely holds a premium to the broader market, as the S&P 500 trades at 22.1 times forward earnings. Considering how important Alphabet is to many industries, it seems criminal that the stock trades that close to the S&P 500.

However, you have to take what the market gives you, and right now, it's a smoking hot deal on Alphabet stock. Investors shouldn't expect this deal to hang around for much longer, so take advantage of it while you can.

Should you invest $1,000 in Amazon right now?

Before you buy stock in Amazon, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Amazon wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $775,568!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of June 24, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool's board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool's board of directors. Keithen Drury has positions in Alphabet and Amazon. The Motley Fool has positions in and recommends Alphabet and Amazon. The Motley Fool has a disclosure policy.

2 Trillion-Dollar Stocks I'm Buying Hand Over Fist was originally published by The Motley Fool