2 Top Artificial Intelligence (AI) Stocks Ready for a Bull Run

It seems virtually impossible to talk about tech without artificial intelligence (AI) being one of the first subjects that pops up. It's not a new technology, but recent developments have shined unprecedented light on it and worked wonders for the stock prices of many companies even remotely dealing with AI.

Despite the AI-fueled runs for many stocks, there are still chances for many companies to experience continued growth. The following two companies, in particular, are prime targets worth considering for your portfolio. Each has had an impressive year but more could be left in the tank.

1. Broadcom

Broadcom (NASDAQ: AVGO) is known for the semiconductors and networking hardware it manufactures, so it may surprise some to see it placed in an article about AI. However, Broadcom plays an important role in the AI ecosystem, which has drawn investors to the stock and pushed it up an impressive amount in the past year.

Broadcom's role in AI is best described by working backward, beginning with how AI models are trained. For AI to be effective, it needs to be trained using massive amounts of data that can't be stored by traditional means. Instead, this data must be kept and processed in data centers.

Inside these data centers are optical connections, networking chips, and accelerators that are responsible for transferring massive amounts of data quickly and reliably. And guess who manufactures many of those items? Broadcom.

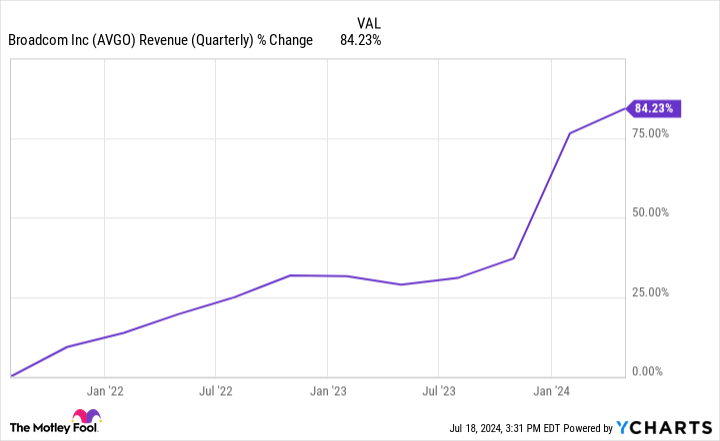

AI-related revenue is a small part of Broadcom's revenue -- $3.1 billion of the $12.5 billion it generated in the second quarter -- but this number will surely increase in the coming years. In 2021, AI revenue was less than 5% of Broadcom's semiconductor solutions revenue. It expects this number to jump to 25% by the end of this year.

While Broadcom benefits from AI-fueled growth, it's not totally dependent on it, which is great news in the event of a downturn in the AI market.

2. Alphabet

Alphabet (NASDAQ: GOOG)(NASDAQ: GOOGL) played an important role in bringing AI to what it is today. Google Brain was a deep learning research project that contributed to advancements in machine learning, and DeepMind (which Alphabet acquired in 2015) is known for its leading AI research.

After a couple of initial blunders -- like its generative AI tool, Bard, returning inaccurate information in a promotional ad -- Alphabet took a lot of flack for lagging behind despite seemingly having a head start. It's since taken steps to address these concerns, such as rebranding Bard to Gemini, a more comprehensive and reliable generative AI tool.

Google advertising is by far Alphabet's biggest revenue generator, accounting for $61.7 billion of the company's $80.5 billion in revenue in Q1. This could see a boost with the introduction of AI Overviews, which are responses that sometimes appear at the top of Google searches. It may take away from Alphabet's revenue from users clicking on search ads, but it opens additional revenue opportunities with the new format.

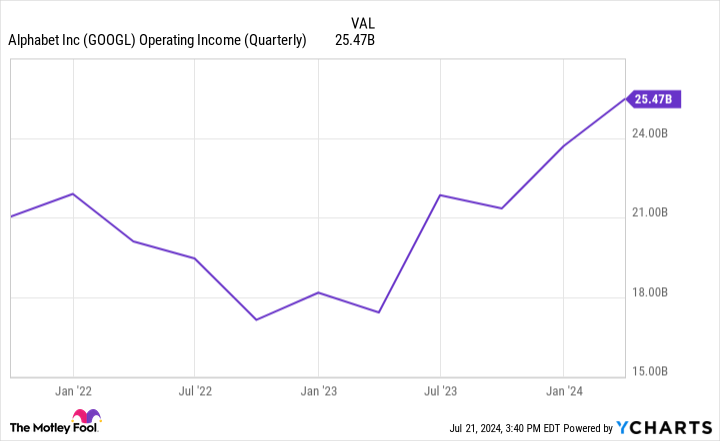

Advertising aside, Alphabet's cloud platform, Google Cloud, stands to gain a lot from recent developments. With an 11% market share, it lags behind Amazon Web Services (31%) and Microsoft Azure (25%), but it's picking up encouraging momentum in scale and profitability. In Q1, Google Cloud revenue grew 28% from a year ago to $9.6 billion, and its operating income increased by over 370% to $900 million.

Alphabet is reportedly in talks to buy cybersecurity start-up Wiz for $23 billion, which would mark its biggest acquisition ever, beating out the $12.5 billion it paid for Motorola in 2012. Wiz uses AI to provide cybersecurity solutions, and this addition should surely boost Google Cloud's appeal to its enterprise customers.

Google Cloud has a long way to go before its importance is anywhere near Alphabet's advertising business, but it should be a huge growth area for Alphabet going forward. Add in the company's relatively low valuation (compared to other Magnificent Seven stocks) and Alphabet seems like a bargain primed for a run in the near future.

Should you invest $1,000 in Broadcom right now?

Before you buy stock in Broadcom, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Broadcom wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $722,626!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of July 22, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Stefon Walters has positions in Microsoft. The Motley Fool has positions in and recommends Alphabet, Amazon, and Microsoft. The Motley Fool recommends Broadcom and recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

2 Top Artificial Intelligence (AI) Stocks Ready for a Bull Run was originally published by The Motley Fool