2 Tech Stocks You Can Buy and Hold for the Next Decade

It's been another great year for the stock market. As of this writing, the benchmark index, the S&P 500, is up nearly 18%.

Yet, if you know where to look, there are even better long-term buy-and-hold opportunities out there. Let's cover two tech stocks that are each up more than 50% year to date.

Spotify Technologies

Spotify Technologies (NYSE: SPOT) tops the list of tech stocks you can buy and hold for the next decade. The company, which operates the world's largest audio streaming platform, continues to impress.

Since the start of 2023, shares of Spotify are up 339%, making it one of the top-performing stocks over that period. The secret to its stock market success? Spotify has combined revenue growth with cost-cutting. When done right, that's a powerful combination.

Spotify's trailing-12-month revenue has increased to $15.7 billion, up from $13.6 billion one year ago. Similarly, 12-month net income has increased to $500 million versus a nearly $800 million loss a year earlier.

In terms of revenue, the company relies on its premium users to provide roughly 90% of its sales. Those users pay a subscription fee for access to ad-free music, podcasts, and audiobooks. Meanwhile, the company derives about 10% of its total revenue from ad-based listening.

Regarding its expenses, Spotify has embarked on a series of cost-cutting measures over the last few years, including reducing staff levels, trimming its marketing budget, and canceling some content projects.

In turn, the company is firing on all cylinders. Granted, Spotify operates in a competitive field, with Apple, Amazon, and Alphabet all offering their own form of audio streaming.

However, Spotify has more than held its own. With over 600 million listeners and almost 250 million subscribers, Spotify has established itself within the audio streaming market. Investors looking for a growth stock with legs should consider Spotify.

Meta Platforms

Next is Meta Platforms (NASDAQ: META), the operator of Facebook and Instagram.

Granted, I've had my concerns with Meta, particularly around the tens of billions of dollars the company chose to spend on the Metaverse. However, one fact is undeniable: Meta generates cash at an almost unbelievable level. This company can afford to take some expensive risks. And I'm sure that's one of the reasons Meta CEO Mark Zuckerberg felt comfortable pouring $46 billion into the company's Reality Labs segment -- money that heretofore has not generated any return.

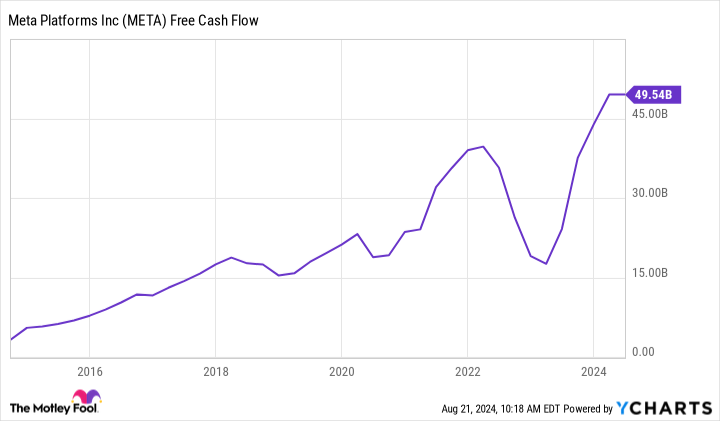

At any rate, let's take a closer look at Meta's cash flow. In the last 12 months, the company has generated $50 billion in free cash flow.

META Free Cash Flow data by YCharts

It's a staggering sum, and it puts Meta into rarified air. Its $50 billion in free cash flow, for example, is comparable to the total free cash flows from energy giants ExxonMobil and Chevron -- combined.

No wonder the company initiated its first-ever regular dividend payment this year. After all, finding the cash to pay for those dividends is no problem. The new payout policy shows that Facebook has plenty of surplus cash profits on hand, in search of a shareholder-friendly cash management policy.

What's more, as long as Meta Platforms remains disciplined in its spending, there's plenty more cash flow on the way. Analysts expect the company to grow its sales by 20% this year and a further 13% in 2025. Those rising revenue figures should support even more free cash flow and perhaps even higher dividend payouts at some point. All of this should make investors happy to own Meta Platforms for the next decade.

Should you invest $1,000 in Meta Platforms right now?

Before you buy stock in Meta Platforms, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Meta Platforms wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $792,725!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 22, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool's board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Jake Lerch has positions in Alphabet, Amazon, ExxonMobil, and Spotify Technology. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Chevron, Meta Platforms, and Spotify Technology. The Motley Fool has a disclosure policy.

2 Tech Stocks You Can Buy and Hold for the Next Decade was originally published by The Motley Fool