2 Growth ETFs to Buy With $200 and Hold Forever

If you want your money to grow over the long term, your best bet is likely an exchange-traded fund (ETF) that invests in the S&P 500. These ETFs are some of the cheapest to own, letting you keep more of your money over time. And they essentially match the market's performance, ensuring you'll never underperform the broader market.

But what if you want to grow your money even faster than the S&P 500? That's not easy to do, but these two growth ETFs will give your portfolio a big leg up.

Use this strange trick to potentially beat the S&P 500

Want to beat the S&P 500 over the long term? One idea is simply to buy the SPDR S&P 500 ESG ETF (NYSEMKT: EFIV). As the name suggests, this fund invests in S&P 500 companies, with a focus on companies with a high ESG rating. ESG stands for environmental, social, and governance. In a rough way, this metric tries to gauge a company's impact on social and environmental issues. Cigarette and fossil fuel companies may receive a low score, while healthcare and technology businesses may receive a higher score -- although there are big differences in how individual companies are ranked.

The good news is that this bit of extra management comes at very little cost. The SPDR S&P 500 ETF (NYSEMKT: SPY) has an expense ratio of 0.09%, while the ESG variant charges 0.10% -- only a bit more expensive.

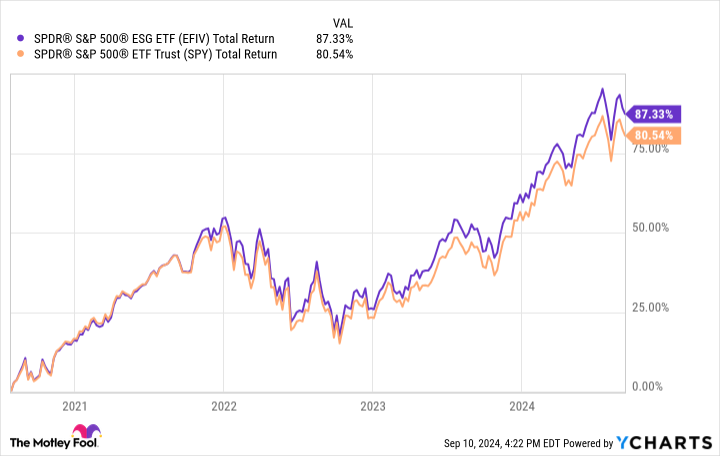

Over the past five years, the S&P 500 ESG ETF has outperformed the S&P 500 ETF by a healthy margin of nearly 7 percentage points. The reason is twofold. First, major investing icons like Larry Fink have been encouraging major market participants to place a premium on a company's ESG rating. He believes these factors will grow in importance over time, and companies that address their ESG rankings will see a greater influx of capital, and thus a relative premium versus their lower ranked peers. Second, the ESG category typically overweights technology companies, a sector that has performed very well in recent years. For instance, the S&P 500 ESG ETF has a heavier weight for companies like Microsoft, Apple, and Nvidia -- three of the market's biggest all-stars over the past decade.

If you want to bet on a low-cost ETF that has beaten the S&P 500 in recent years through a focus on ESG investing -- a category that includes many of the top growth stocks on the market today -- this fund is for you.

Go even bigger with this supercharged growth ETF

Want to add even more growth potential to your portfolio? Go with the Grayscale Bitcoin Trust (NYSEMKT: GBTC). This fund is solely invested in Bitcoin, giving you instant exposure to Bitcoin's price movements. Over the past 12 months, Bitcoin has more than doubled in value, although it has pulled back 15% over the past six months. If you've been wanting to invest in cryptocurrencies, this is your chance.

The Grayscale Bitcoin Trust isn't perfect. It charges a relatively high expense ratio of 1.5%, and also has some tracking error. So if you really want to go all in, you're likely better off just buying Bitcoin directly. But if you want to easily add cryptocurrency exposure to your portfolio, this ETF will do the trick.

With a total market cap of $1.1 trillion, Bitcoin likely still has plenty of upside as a store of value. Gold, for comparison, has a total market cap of around $15 trillion. Plus, there's plenty of long-term optionality when it comes to Bitcoin's transactional usage and overall place in the growing crypto ecosystem. Few investments have grown in value as quickly as Bitcoin has over the years. And while buying Bitcoin directly is likely your best long-term option, this ETF is a far simpler option for most investors.

Should you invest $1,000 in SPDR Series Trust - SPDR S&P 500 Esg ETF right now?

Before you buy stock in SPDR Series Trust - SPDR S&P 500 Esg ETF, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and SPDR Series Trust - SPDR S&P 500 Esg ETF wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $729,857!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 9, 2024

Ryan Vanzo has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Apple, Microsoft, and Nvidia. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

2 Growth ETFs to Buy With $200 and Hold Forever was originally published by The Motley Fool