Up 19% Year to Date, Can Gold Outperform the S&P 500 and Nasdaq Composite by the End of 2024?

It has been a great year for the broader indexes like the S&P 500 and Nasdaq Composite, which are both up over 18% year to date. Investor enthusiasm for sustained economic growth and higher earnings, especially from megacap tech companies, is propelling the rally.

But gold is quietly up nearly 20% year to date -- outperforming the S&P 500. Prices of the yellow stuff are knocking on the door of $2,500 per ounce -- a more than $600-per-ounce climb from levels seen last fall.

Here's how to approach gold right now, some of the catalysts driving the price higher, and whether gold is worth investing in.

A safe haven amid uncertainty

Plenty of factors influence gold prices -- such as basic supply and demand. If a major buyer (like a country) is loading up on gold reserves, but gold mining is down, then the price could rise due to a supply/demand imbalance. It could also fall if production soars from a newly discovered mine, or a major producer expands its output. Since gold is a global market, the price can also vary based on where gold is being purchased and in what quantity -- as is the nature of commodities that are prone to arbitrage.

Monetary policy also impacts the price of gold. Lower interest rates can boost spending and weaken the U.S. dollar, which can raise the price of dollar-denominated gold.

In general, the single greatest catalyst that can drive gold prices is its use as a store of value. Gold starkly contrasts a fiat currency like the U.S. dollar -- which has no intrinsic value and is instead backed by the strength of the U.S. economy. Fears of instability can lead to increased interest in gold.

Whereas equity markets love certainty, the gold market benefits from instability. Basically, gold can be a place of refuge when the economy is under pressure and geopolitical tensions are running high.

An epic rally in equities and gold

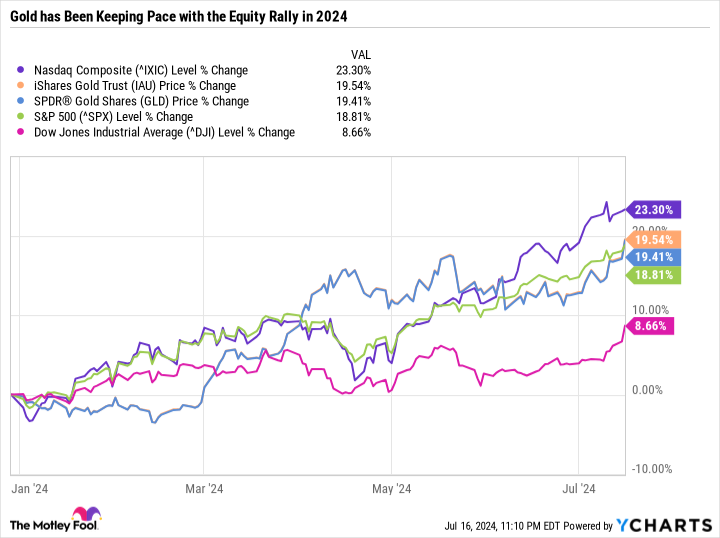

The following chart shows two sizable gold exchange-traded funds (ETFs) -- the SPDR Gold Shares ETF (NYSEMKT: GLD) and the iShares Gold Trust (NYSEMKT: IAU) compared to the performance of the Nasdaq Composite, S&P 500, and Dow Jones Industrial Average so far this year.

ETFs are an alternative to buying physical gold bullion or gold coins -- which can have a markup over the spot price, security risks, and potentially high storage fees. SPDR Gold Shares and the iShares Gold Trust own gold assets and use a custodian that holds the gold on their behalf. SPDR Gold Shares charges a 0.4% expense ratio, or $4 for every $1,000 invested compared to a 0.25% expense ratio for the iShares Gold Trust. Both ETFs can be simpler, lower-cost, and more liquid ways to invest in gold.

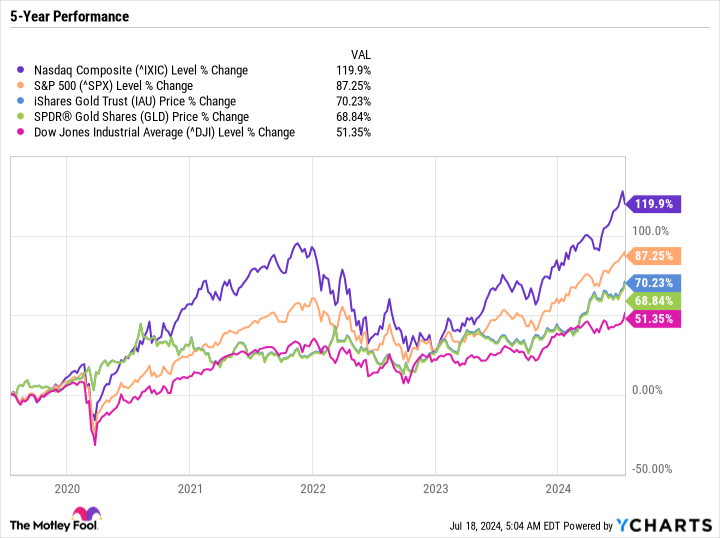

Historically, it is fairly uncommon to see gold keep pace with a sizable rally in the major U.S. equity indexes. But over the last five years, gold has put up monster gains -- not quite as good as the Nasdaq Composite or S&P 500, but better than the Dow and far better than a risk-free rate or bond.

Gold vs. the U.S. stock market

The challenge with owning gold long-term is that it doesn't have the same growth catalysts as equities. Growth stocks can increase in value based on their potential future earnings.

Blue chip dividend stocks like Coca-Cola steadily grow their earnings and, in turn, their payout to investors. The passive income component, paired with potential growth in the value of the business, is a clear reason to buy and hold this type of stock.

Gold doesn't have a management team or financial statements. Its supply and demand are changing. It has some utility, but not in the same way oil or electricity are valued.

But gold is a globally recognized store of value and has been for millennia. It has a track record that far exceeds any single company or economy.

Gold can be seen as a way to protect wealth, especially for countries without a stable fiat currency.

Introducing gold to your portfolio

The simplest way for gold to outperform the major indexes in 2024 is if U.S. stocks pull back. This could happen for a variety of reasons, like valuation concerns or some major companies missing earnings estimates. Gold could also keep rising if uncertainty increases due to myriad factors, such as economic indicators like interest rates, credit card debt, housing prices, or geological reasons.

Recommendations vary, but gold should probably be no more than 5% to 10% of a diversified portfolio. However, stocks provide a far better potential investment over the long term.

If you are worried about a stock market sell-off, a better approach than pounding the sell button and fleeing to gold is ensuring that your portfolio aligns with your risk tolerance. Having too much of a portfolio in expensive growth stocks may not be the best decision if it doesn't align with your investment time horizon or risk tolerance. Putting new capital to work in value-orientated sectors of the market is an excellent way to stay invested while also balancing out your portfolio.

In sum, there are plenty of safer asset classes out there. Gold is one of them, and it has been surging due to forecasts for lower interest rates, increased economic and political uncertainty, and other factors. But overhauling a portfolio's composition just because of something that could happen in the short term is a great way to lose your shirt.

The best way to approach gold is to determine your desired allocation in your portfolio and how you want to split up that allocation between physical gold, gold ETFs, or even gold mining stocks. That way, you can enforce checks and balances on your portfolio and ensure you set yourself up to hit your financial goals rather than teeter on the brink of speculation.

Should you invest $1,000 in SPDR Gold Trust right now?

Before you buy stock in SPDR Gold Trust, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and SPDR Gold Trust wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $741,989!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of July 15, 2024

Daniel Foelber has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Up 19% Year to Date, Can Gold Outperform the S&P 500 and Nasdaq Composite by the End of 2024? was originally published by The Motley Fool