Up 17% This Year, Is QuantumScape Stock a Millionaire Maker?

The capital markets have been roaring so far this year. Through the first six months of 2024, the S&P 500 gained 14% while the Nasdaq Composite soared by 18%. One stock that has not fared so well though is QuantumScape (NYSE: QS). From January through the end of June, shares of the electric vehicle battery maker cratered 29%.

However, earlier this month QuantumScape announced a major new development with its existing partner, Volkswagen. In the month of July alone, QuantumScape stock is up a whopping 66% -- erasing all of its prior losses for most of this year. With shares now up 17% year to date, some investors may be wondering if QuantumScape has the potential to keep soaring and potentially make you a millionaire.

Let's dig into what's going on at QuantumScape and assess if now is a lucrative opportunity to buy some shares.

The potential to revolutionize electric vehicles, but...

QuantumScape builds and manufactures solid-state batteries for electric vehicles. The company claims that its solid-state solutions are superior to more commonly used lithium-ion batteries because they can charge EVs more quickly, which can also help save money for consumers.

Moreover, QuantumScape believes that solid-state batteries also have longer range than lithium-ion batteries used today -- thereby mitigating the risk of range anxiety that many EV drivers and potential buyers cite.

While solid-state batteries have the potential to completely shift the current technology that's widely used across EVs today, investors should know a few things before pouring into the potential QuantumScape represents.

...the company has a long way to go

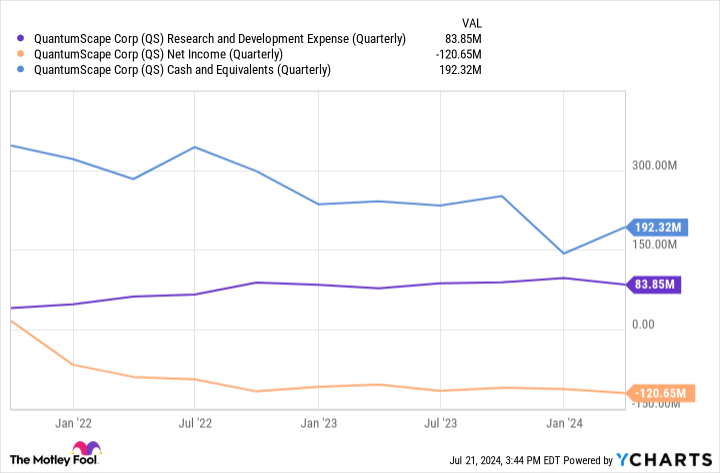

Developing these solid-state batteries is both an ambitious and costly undertaking. Namely, QuantumScape is spending tens of millions of dollars on capital expenditures (capex) and research and development on a consistent basis.

During the first quarter of 2024, QuantumScape spent $14.1 million in capex and guided for full-year spend to be in the range of $70 million to $120 million. Furthermore, as seen in the chart above, the company spent $84 million on research and development just during the first three months of the year.

Considering QuantumScape is still a pre-revenue business, these operating losses will only compound and materially impact the company's balance sheet from a liquidity standpoint.

Can QuantumScape stock make you a millionaire?

At the time of this writing, QuantumScape boasts a market cap of roughly $4 billion. It's pretty hard to justify a valuation well north of a billion dollars considering QuantumScape is yet to monetize its products, and continues to spend hundreds of millions of dollars to build prototypes.

I am sense that a lot of future value may already be baked into QuantumScape stock. Moreover, I think a good deal of this bullish sentiment heavily revolves around the company's various partnerships and joint ventures -- namely, its relationship with Volkswagen.

While I find it an intriguing business and am interested in its underlying technology, I would caution investors to distinguish between its potential versus the current state of the company. The reality is that QuantumScape remains a high-cash-burn operation and is a highly volatile stock.

At best, I see QuantumScape as a speculative investment and not one that should be a core component of your portfolio. The company has not done enough in my eyes to warrant its valuation, let alone assure investors that the business will be intact for the long run. Given this level of risk, I yet don't think QuantumScape is a millionaire maker.

Should you invest $1,000 in QuantumScape right now?

Before you buy stock in QuantumScape, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and QuantumScape wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $751,180!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of July 22, 2024

Adam Spatacco has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Volkswagen Ag. The Motley Fool has a disclosure policy.

Up 17% This Year, Is QuantumScape Stock a Millionaire Maker? was originally published by The Motley Fool