1 Unstoppable Multibagger Up 4,290% Since 2000 to Buy and Hold Forever Following its $1.1 Billion Acquisition

Founded in 1959, Iowa-based Casey's General Stores (NASDAQ: CASY) has steadily expanded through the Midwest to become the third-largest convenience chain by store count in the United States. While this size alone makes Casey's a major player in the convenience store (c-store) industry, it is the company's beloved pizza that sets it apart from the crowd.

As the fifth-largest pizza chain by number of kitchens in the U.S., Casey's often acts as the de facto centerpiece eatery of many small communities throughout the Midwest. With roughly half of its stores located in towns of less than 5,000 people, the company's pizza is the top, if not only, option for customers looking to pick up dinner after work or for football games on the weekend.

Powered by its beloved status across the rural communities it serves throughout the Midwest, Casey's has delivered a total return of 4,290% since 2000, rocketing past the S&P 500's mark of 487%.

Despite becoming a 43-bagger in just under 25 years, Casey's General Stores should still have plenty of gas left in the tank for investors. Here's what makes the company a stellar "forever" investment, especially following its recent acquisition.

Casey's General Stores: A Midwest staple with growth ambitions

Despite adding 984 new units to its 2,900 store total over the last decade, Casey's growth could still be in its early innings.

First, roughly 75% of the towns (with a population of less than 20,000) that reside within reach of the company's distribution centers do not yet have a Casey's General Store. Though we can't expect the company to completely inundate its operations in every one of these open areas, the figure nonetheless highlights the remaining growth runway available within Casey's existing footprint.

Second, on the profitability growth side of things, the company has a number of forces working in its favor that could bring about higher margins over the long haul. One tailwind is Casey's impressive rewards platform of over 8 million members. Visiting the stores 15% more often while spending 13% more on each transaction compared to guests, these loyal members create a stickier base of sales for the company to count upon in any economic environment.

Another tailwind for Casey's profitability comes from its rapidly growing private label operations, which accounted for 9% of inside sales as of the most recent quarter. These 300-plus private label products not only bring higher margins than branded items but pair nicely with Casey's rewards ecosystem as the company can steer customers toward its in-house items.

Last but not least, however, Casey's most powerful growth lever remaining could be its continued geographic expansion, whether through building new stores or leaning upon its newly formed mergers and acquisitions (M&A) team. Recently spending a hefty $1.1 billion to acquire Fikes Wholesale and its 198 CEFCO c-stores across the southern U.S., management may be tipping its hand regarding its long-term expansion plans.

Why Casey's $1.1 billion acquisition fits its long-term growth strategy

Having already acquired 182 new stores in 2022, Casey's had previously been tiptoeing further south. However, the CEFCO buyout acts as more of a "launch full-speed ahead" into the region. Bringing in 148 new stores in Texas, along with 27 in Florida, 13 in Alabama, and 10 in Mississippi, the company is set to grow its store count by 7% from this transaction alone.

What makes this acquisition so appealing to investors is that Casey's doesn't merely absorb these businesses and move on. Rather, it rebrands them, brings them into the company's distribution network, and retrofits them with a pizza kitchen, which has historically led to recently acquired stocks seeing their food sales spike.

Following their remodel, new stores from M&A typically see a 70% increase in earnings before interest, taxes, depreciation, and amortization (EBITDA) by their fourth year of integration. With Casey's generating a prepared food margin of 59%, compared to CEFCO's margin of 31%, it is likely that history will repeat itself as the company plans to put kitchens in 85% of the newly remodeled CEFCO stores.

After accounting for expected tax benefits and EBITDA synergies, management estimates that it will only have paid 7 times EBITDA for the CEFCO c-stores, which would be a steal.

Should investors go all-in on Casey's stock today?

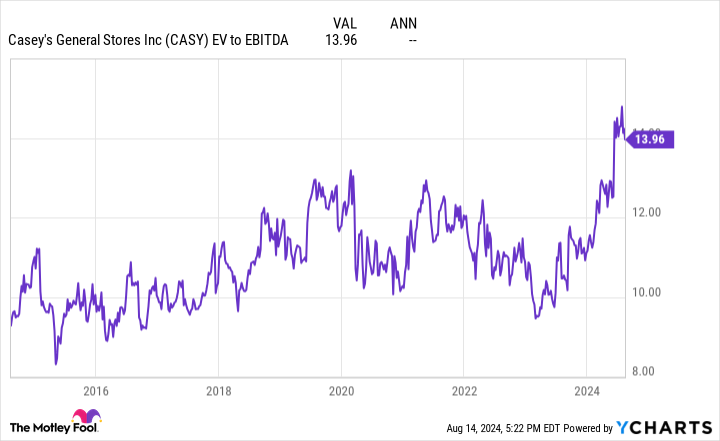

With management guiding for 8% to 10% EBITDA growth annually through 2026, Casey's recently elevated EV-to-EBITDA ratio of 14 may not feel like a massive bargain.

However, management is also guiding to generate $1.25 billion in free cash flow (FCF) by 2026 -- even as it expects to add 150 more stores. Should Casey's reach this FCF goal (and it has done a good job of living up to similar goals in the past) it's current enterprise value would be just 12 times this figure -- which is a deep discount to the market's averages.

In addition to this potentially cheap valuation, Casey's is almost halfway home to becoming a Dividend King with 24 consecutive years of dividend increases. While the company's dividend yield is only 0.5%, these payouts use just 13% of Casey's net income, leaving ample room for continued increases.

Ultimately, Casey's combination of steady operations, consistent growth, and a recently heightened but fair valuation make it a perfect candidate for dollar-cost averaging buys over time.

Should you invest $1,000 in Casey's General Stores right now?

Before you buy stock in Casey's General Stores, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Casey's General Stores wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $763,374!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 12, 2024

Josh Kohn-Lindquist has positions in Casey's General Stores. The Motley Fool recommends Casey's General Stores. The Motley Fool has a disclosure policy.

1 Unstoppable Multibagger Up 4,290% Since 2000 to Buy and Hold Forever Following its $1.1 Billion Acquisition was originally published by The Motley Fool