1 No-Brainer Growth Stock I Can't Wait to Buy Again if the Market Crashes

For longer than most folks reading this have been alive, Warren Buffett has been getting rich by acting greedy while the rest of the market is fearful. According to one popular indicator, it's nearly time to start acting greedy.

A key measure of stock market fear, the CBOE S&P 500 Volatility Index, or VIX, spiked above 60 points on the morning of Monday, Aug. 5. That's higher than it's been since the COVID-19 pandemic decimated markets in the spring of 2020.

The situation appeared dire on Aug. 5, when the S&P 500 index fell to 8.5% below the high-water mark it set in July. It takes a drawdown of 10% before we can say we're in a market correction.

We don't like seeing the stocks in our portfolios fall during market corrections, but there's always a silver lining for long-term investors. Since the price you pay for an asset determines your rate of return, you can view shares of superb businesses falling due to macroeconomic pressure as an opportunity instead of a disaster.

Shares of one of the innovative businesses I'm invested in, TransMedics Group (NASDAQ: TMDX), have more than doubled since I first bought them. I'd like to own more, but its market valuation has been too high to fit my risk tolerance level. Here's why I'll be excited to buy more of this stock if a market crash knocks it down a few pegs.

Why TransMedics stock is soaring

TransMedics markets an organ care system (OCS) for hospitals and transplant centers. From the end of 2023 through Aug. 7, TransMedics stock rocketed 84.5% higher in response to sales that are soaring now that its OCS is the only solution approved by the Food and Drug Administration (FDA) to maintain multiple solid organs.

TransMedics was constrained by a lack of available charter flights, so it acquired an aviation business last summer. This gives it an extra degree of leverage over hospitals and transplant centers. With the ability to charge extra for transportation, total revenue in the first half of 2024 rocketed 125% higher year over year to $211.2 million.

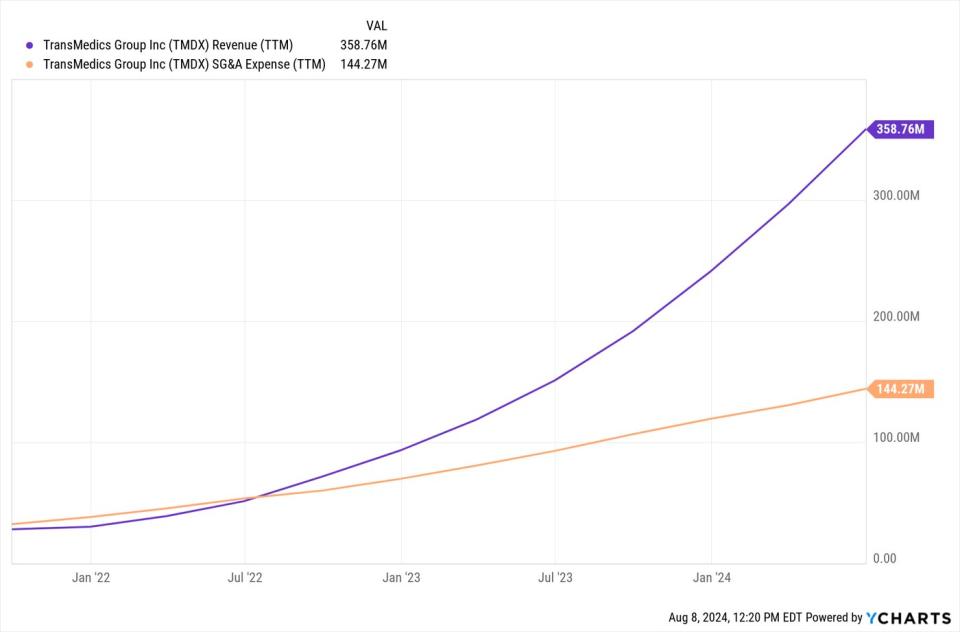

Transmedics had to increase staff to more than double revenue, but not by much. Sales, general, and administrative expenses are up by just 45% year over year in the first half of 2024.

Sales that are outpacing expenses by a mile pushed net income up to $24.4 million in the first half of 2024 from a loss in the previous year period.

Why TransMedics isn't finished outperforming

TransMedics is singlehandedly improving the way donated hearts, lungs, and livers are stored after they're donated. There's a lot of room for improvement because the standard procedure is to keep them on ice while delivering them to an operating room.

The TransMedics OCS pumps warm blood through donated organs, which makes a big difference. For example, in the Inspire study, patients receiving lungs maintained with an OCS were about 50% less likely to experience severe primary graft dysfunction than patients receiving lungs maintained with cold storage.

This company's OCS does more than improve outcomes. It makes organs that would have been rejected viable. In the past, hearts donated after circulatory death (DCD) were typically discarded in favor of hearts donated after brain death (DBD), which are far less common.

These days, TransMedics is the only system approved by the FDA for DCD heart transplantation. Heart surgeons are generally willing to transplant a DCD heart that's been maintained in a TransMedics OCS because survival rates post-transplant are higher than they are for DBD hearts maintained with cold storage.

What to look for

TransMedics boasts a $4.9 billion market cap at recent prices. Revenue is way up, but this valuation is extremely high for a company that earned just $24.4 million in the first half of the year.

Now that the dust has settled following the acquisition of its aviation business, earnings could accelerate in the quarters ahead. That said, investors who buy at recent prices could suffer swift and heavy losses if, for any unforeseen reason, net income doesn't start rising sharply.

Buying TransMedics stock at recent prices isn't necessarily a bad idea, but it presents more risk than most investors should be comfortable with. Risk-averse investors want to wait for a significant pullback before pulling the trigger on this magnificent growth stock.

Should you invest $1,000 in TransMedics Group right now?

Before you buy stock in TransMedics Group, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and TransMedics Group wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $641,864!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 6, 2024

Cory Renauer has positions in TransMedics Group. The Motley Fool has positions in and recommends TransMedics Group. The Motley Fool has a disclosure policy.

1 No-Brainer Growth Stock I Can't Wait to Buy Again if the Market Crashes was originally published by The Motley Fool