1 No-Brainer Growth ETF to Buy Right Now for Less Than $500

Every long-term investor should consider having some exposure to growth stocks, companies that are rapidly growing their revenue and earnings. Even the most conservative investor can benefit from owning a high-quality exchange-traded fund that offers instant, diverse growth stock exposure with a single ticker symbol.

And as far as growth ETFs go, the Invesco QQQ Trust (NASDAQ: QQQ) is tough to beat.

I'll explain below why the Invesco QQQ is the best growth ETF you can buy under $500 and how best to implement it into your long-term investment strategy.

What is the Invesco QQQ ETF?

The Invesco QQQ is an exchange-traded fund (ETF), a basket of stocks that trades under one ticker symbol. Most ETFs might mimic a stock market index or focus on a specific niche. The Invesco QQQ follows the Nasdaq-100, an index of the 100 largest non-financial companies trading on the Nasdaq stock exchange. The Nasdaq is popular among technology companies, so the Nasdaq-100 and the Invesco QQQ, by association, lean heavily into the technology sector. Technology stocks make up just over half of the Invesco QQQ.

A group of the world's largest tech stocks, often referred to as the "Magnificent Seven," dominate the ETF's top 10 holdings:

Company | Percentage of Invesco QQQ |

|---|---|

Apple | 8.91% |

Microsoft | 8.49% |

Nvidia | 7.72% |

Broadcom | 4.98% |

Amazon | 4.96% |

Meta Platforms | 4.30% |

Tesla | 3.12% |

Alphabet Class A Shares | 2.71% |

Alphabet Class C Shares | 2.61% |

Costco | 2.49% |

Data source: Invesco QQQ Prospectus.

The fund's remarkable 10-year return of over 430% bests the broader Nasdaq's 340% and the S&P 500's 234%.

Why does it continue to perform so well?

The Invesco QQQ's stellar performance boils down to a couple of simple mechanisms:

First, the Nasdaq-100 is a market cap-weighted index. That means that larger companies represent a more significant portion of the index. The better stocks perform, the larger they grow and the more weight they have. In other words, the index leans harder into winning stocks. That's why these enormous technology giants dominate the Invesco QQQ.

Second, the ETF's top holdings, these technology giants, have enjoyed growth virtually unmatched by anything in history. Just think about all the industries these Magnificent Seven companies dominate today:

Cloud computing

E-commerce

Internet search

Internet advertising

Smartphones

Electric vehicles

Semiconductors

These industries are worth hundreds of billions of dollars (trillions in some cases), and many are still growing! Meanwhile, these juggernaut companies collectively generate hundreds of billions of dollars in annual cash profits, which fund innovation and acquisitions that open new doors and keep smaller competitors out. In most cases, these companies compete with each other and few others.

Invesco QQQ's concentration on these huge technology winners has fueled its remarkable investment returns.

Here is the smartest way to invest in the ETF

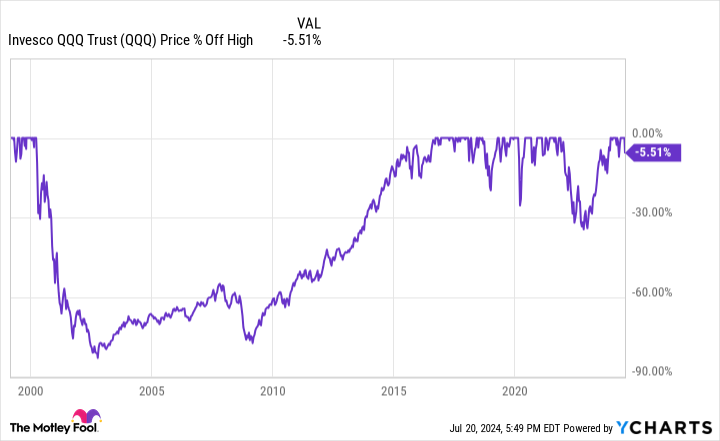

Concentrating so heavily on relatively few stocks is a double-edged sword that can cut badly when things go south. You can see just how sharply the Invesco QQQ can plummet during a market crash:

There's a solid argument that technology stocks are in an AI-driven bubble. Does that mean you should avoid buying shares in the Invesco QQQ?

Not necessarily. Here's why:

The Invesco QQQ launched in 1999 near the height of the dot-com bubble. The market crashed the following year, the worst downturn for technology stocks in history. Talk about lousy timing. Still, the Invesco QQQ has outperformed the S&P 500 by nearly 400 percentage points over its lifetime!

Remember, nobody can perfectly predict if or when a market crash will occur.

Here's the game plan: Buy shares in the Invesco QQQ ETF slowly over time. Pick up a share here, a share there. You'll slowly build an investment with a cost that averages out. That way, you'll benefit if technology stocks keep thriving while having the ability to be opportunistic if the market does break down.

The future looks bright for technology growth stocks. Many existing growth trends still have years ahead of them, and artificial intelligence could add trillions of dollars to the global economy over the next decade and beyond. The Invesco QQQ is arguably the most effective and simple way to position your portfolio for that growth.

Should you invest $1,000 in Invesco QQQ Trust right now?

Before you buy stock in Invesco QQQ Trust, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Invesco QQQ Trust wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $751,180!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of July 22, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool's board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool's board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool's board of directors. Justin Pope has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Costco Wholesale, Meta Platforms, Microsoft, Nvidia, and Tesla. The Motley Fool recommends Broadcom and recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

1 No-Brainer Growth ETF to Buy Right Now for Less Than $500 was originally published by The Motley Fool