1 Dividend Growth ETF That Can Turbocharge Your Portfolio

Dividend growth stocks have long been a cornerstone of successful investment strategies, offering a potent combination of steady income and potential capital appreciation. These companies, known for consistently increasing their dividend payouts, often demonstrate strong financial health, solid fundamentals, and thriving business models.

For investors seeking exposure to this lucrative market segment, exchange-traded funds (ETFs) that own shares of dividend growth stocks provide a convenient and diversified approach. While individual stock selection can be time-consuming and require extensive research, ETFs offer a streamlined solution. They allow investors to gain exposure to a basket of dividend stocks.

Meet the iShares Core Dividend Growth ETF

Among the various dividend growth ETF options, the passively managed iShares Core Dividend Growth ETF (NYSEMKT: DGRO) has established itself as a top contender in the space. This fund tracks the Morningstar US Dividend Growth Index, consisting mainly of U.S. companies with a consistent history of growing dividends.

The underlying index applies several key criteria to ensure the quality of its holdings. First, companies must have a track record of at least five years of uninterrupted annual dividend growth. Additionally, the index excludes real estate investment trusts (REITs) and requires companies to have positive consensus earnings forecasts and payout ratios below 75%.

Portfolio composition and yield

The iShares Core Dividend Growth ETF's portfolio composition reflects management's emphasis on quality. The fund's top five holdings are financial giant JPMorgan Chase, healthcare leader Johnson & Johnson, tech innovator Apple, pharmaceutical powerhouse AbbVie, and energy juggernaut ExxonMobil. These companies are renowned for their strong market positions and long-standing commitment to rewarding shareholders through regular dividend increases.

From a yield perspective, the iShares Core Dividend Growth ETF currently offers a distribution yield of 2.26%, comparing favorably to the S&P 500's 1.35%. This higher yield provides investors with a meaningful income stream while still maintaining exposure to companies with growth potential.

Cost-effectiveness and performance

One of the iShares Core Dividend Growth ETF's most compelling features is its cost-effectiveness. With an expense ratio of just 0.08%, it significantly undercuts the average expense ratio of similar funds, which hovers around 0.13%. This low fee structure allows investors to retain more of their returns, compounding the benefits of dividend growth over time.

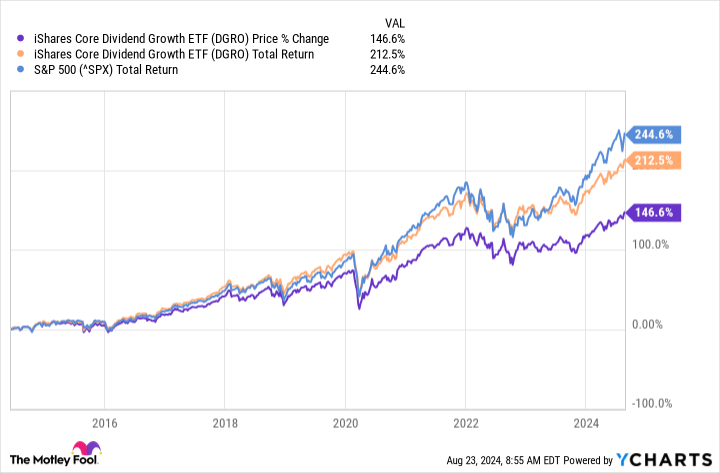

The fund's performance since its inception in 2014 has also been impressive. Investors who reinvested dividends have seen total returns of 212.5% over these 10 years, while those who took distributions still enjoyed a solid 146.6% return on capital.

Suitability for different investor profiles

The iShares Core Dividend Growth ETF's structure makes it suitable for a wide range of investors. For those in the early stages of their investment journey, the fund offers exposure to high-quality companies with the potential for long-term growth.

Retirees or income-focused investors can benefit from the regular cash distributions, using them to supplement their income while maintaining exposure to a diversified portfolio of dividend growers.

However, it's important to note that like all investments, the iShares Core Dividend Growth ETF carries risks. The fund's focus on dividend-paying stocks means it may underperform when growth stocks are in favor.

Additionally, while the companies in the portfolio have historically increased their dividends, there's no guarantee this trend will continue, especially during economic downturns.

Is it a buy?

The iShares Core Dividend Growth ETF offers investors a compelling way to access a diversified portfolio of dividend growth stocks. With its focus on quality companies, attractive yield, and low expenses, it's well-suited for investors seeking income and potential capital appreciation.

While past performance doesn't guarantee future results, the iShares Core Dividend Growth ETF's track record and structure make it an ETF worth considering for those looking to enhance their portfolio's dividend growth exposure.

Should you invest $1,000 in iShares Trust - iShares Core Dividend Growth ETF right now?

Before you buy stock in iShares Trust - iShares Core Dividend Growth ETF, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and iShares Trust - iShares Core Dividend Growth ETF wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $758,227!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 22, 2024

JPMorgan Chase is an advertising partner of The Ascent, a Motley Fool company. George Budwell has positions in Apple. The Motley Fool has positions in and recommends Apple and JPMorgan Chase. The Motley Fool recommends Johnson & Johnson. The Motley Fool has a disclosure policy.

1 Dividend Growth ETF That Can Turbocharge Your Portfolio was originally published by The Motley Fool