In This Article:

(Bloomberg) -- It only took six months and a basket of disguises for Wall Street to love Snap Inc. again.

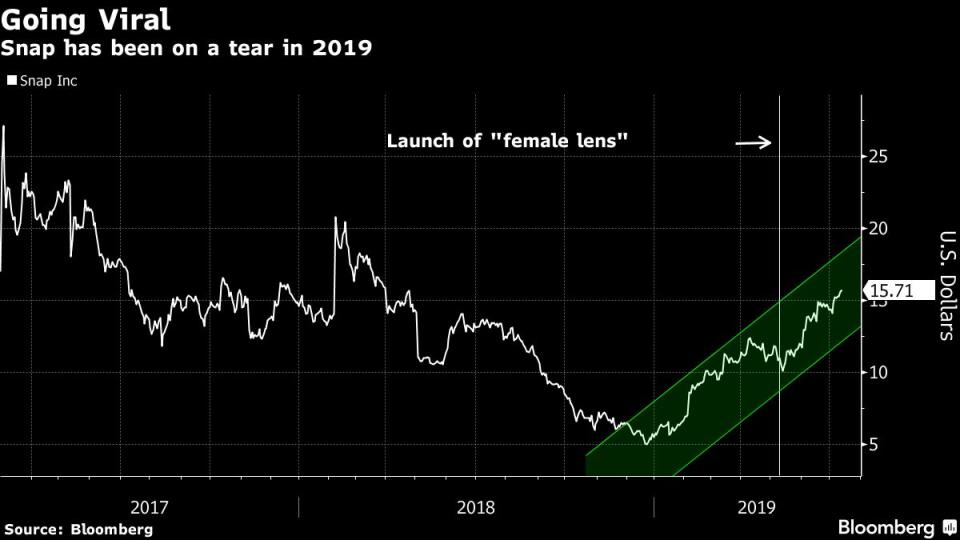

Snap has seen a dramatic recovery over the past several months, with shares more than tripling off a record low in December to trade at their highest level in more than a year. While there have been a number of tailwinds supporting the social-media company, one key ingredient behind the turnaround is this: it now allows users to “swap faces” with others in photographs, with “lenses” or filters that can, for example, make men look like women or babies.

Those who are unfamiliar with the latest viral sensations may view such a feature as an unusual foundation to build an investment on. But Wall Street sees the early-May launch of the filters as a key factor behind improving user trends at the Snapchat app, which is in turn leading to more optimistic projections for Snap’s top- and bottom-lines.

“The timing of the filter appears to have driven a notable increase in engagement,” said Mark Kelley, an analyst at Nomura Instinet.

Snap rose as much as 4.3% on Friday, extending a four-day winning streak, after Goldman upgraded the stock to buy from neutral. The new Android app, games and viral lenses drove record user adoption in May, reversing prior trends, analyst Heath Terry wrote in a research note.

Wall Street’s expectations have been getting rosier, with MoffettNathanson writing that Snap was “on the verge of writing their own ‘Cinderella Story’.” Compared with six months ago, the consensus for Snap’s adjusted full-year loss has improved by about 25% while revenue expectations are up 5.4% over that period.

Bank of America on Thursday raised its revenue estimates on Snap for 2019 through 2021 and lifted its price target to $17 from $12. The firm expects user upside in the quarter. The comments came just two days after Credit Suisse lifted its own target for similar reasons. The shares are now trading at their highest level since March 2018, having more than tripled since December.

In a report dated July 10, Nomura’s Kelly cited data from Sensor Tower that showed 67% growth in Snapchat app downloads in the second quarter. That represents a dramatic turnaround from the first quarter, when downloads fell 5% on a year-over-year basis. According to SimilarWeb data cited by Nomura, traffic to Snapchat.com was up 4% in the second quarter, compared with the first-quarter’s 24% decline.

“The jump is a positive nod to Snap’s efforts to spur engagement and demonstrates the platform’s scale and sway, particularly with millennials,” wrote Jitendra Waral, an analyst at Bloomberg Intelligence.