Realty Income Stock: Buy, Sell, or Hold?

One can forgive investors for wondering what to make of Realty Income (NYSE: O) stock. The company owns nearly 15,500 single-tenant properties in the U.S. and seven European countries. At an occupancy rate of nearly 99%, its business model remains solid.

Despite that benefit, its stock never recovered from its high in early 2020 amid a pandemic and rising interest rates. After over four years of decline and stagnation, should investors buy back into the real estate investment trust (REIT), continue to hold, or stay away altogether?

The state of Realty Income stock

Admittedly, the case for holding the stock is by far the easiest to argue. In addition to the aforementioned occupancy rate, its holdings are single-tenant, net-leased properties. This means the tenant pays the maintenance, taxes, and insurance costs, easing the burden on Realty Income.

Additionally, its tenants are typically high-profile, stable businesses. Retailer Dollar General, casino operator Wynn Resorts, and package delivery company FedEx are part of its tenant base, so its revenue stream is stable.

Moreover, as a REIT, it must pay at least 90% of its net income in the form of a dividend to avoid paying income tax on its operational profits. Its monthly payout has risen at least once per year since beginning in 1994, a testament to its business strategy.

Currently, shareholders receive $3.15 per share annually, a dividend yield of almost 6% at today's prices. Since that is more than 4.5 times the average S&P 500 yield of 1.3%, investors will likely want to maintain that growing income stream.

Is there a Realty Income buy case?

Indeed, rising interest rates seem to have overshadowed those attributes. Still, the rates did not stop Realty Income from acquiring just over 2,000 properties in the Spirit Realty purchase last year. They also have not stopped the development and purchase of 155 additional properties.

Furthermore, the Spirit Realty acquisition has boosted its financials. Its nearly $1.3 billion revenue for the first quarter of 2023 rose 34% from year-ago levels.

Nonetheless, the added expenses and merger-related costs led to total (operational) expenses rising by almost 57% to $1.1 billion. After factoring in non-core income and expenses, net income fell 58% yearly to $130 million.

Still, funds from operations (FFO), a measure of a REIT's free cash flow, rose 15% to $786 million, or $0.94 per share. That was enough to cover the $0.77 per share in payout to common shareholders.

It is also enough to account for mild downward revisions in the company's outlook. Fortunately, the company still forecasts between $4.17 per share and $4.29 per share in FFO for 2024. That would amount to a forward price-to-FFO ratio of less than 13. This is more than enough to cover the recent dividend increase, a factor that should hold investors in good stead.

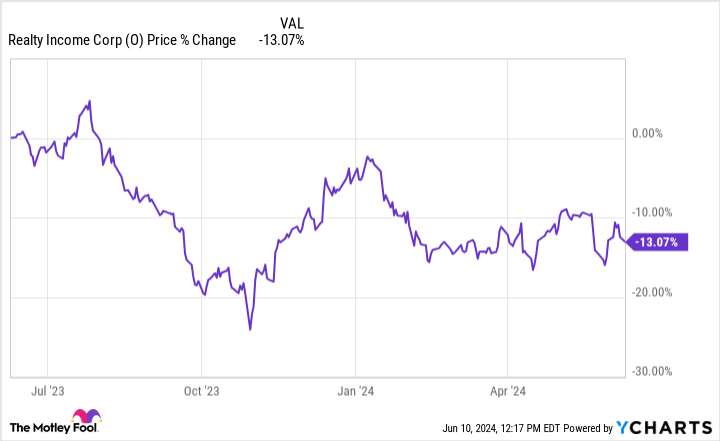

Unfortunately, the aforementioned 6% yield did not fully offset the 13% decline in the stock price over the last year. Although the stock has traded in a range since February, it is not clear whether that represents a pause in the declines or whether it is finally getting ready to turn higher.

Should investors buy, sell, or hold?

At current levels, long-term income investors should consider adding shares. At over 4.5 times the average payout, shareholders receive a considerable return with a 30-year track record of increases. Over time, that could offset the poor performance of the stock in recent years.

Moreover, while Realty Income stock could fall further, the forward price-to-FFO ratio of less than 13 probably means the downside is limited. That factor increases the likelihood that investors will continue to earn increasing payouts and, with patience, market-beating returns.

Should you invest $1,000 in Realty Income right now?

Before you buy stock in Realty Income, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Realty Income wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $767,173!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of June 10, 2024

Will Healy has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends FedEx and Realty Income. The Motley Fool has a disclosure policy.

Realty Income Stock: Buy, Sell, or Hold? was originally published by The Motley Fool