Exploring Kuaishou Technology And 2 High Growth Tech Stocks In Hong Kong

As global markets react to the Federal Reserve's recent rate cut, the Hong Kong market has shown resilience with the Hang Seng Index gaining 5.12%, reflecting a positive sentiment despite broader economic challenges. In this environment, identifying high-growth tech stocks like Kuaishou Technology becomes crucial for investors seeking opportunities in dynamic sectors driven by innovation and consumer engagement.

Top 10 High Growth Tech Companies In Hong Kong

Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

Wasion Holdings | 22.37% | 25.47% | ★★★★★☆ |

MedSci Healthcare Holdings | 48.74% | 48.78% | ★★★★★☆ |

Inspur Digital Enterprise Technology | 25.31% | 39.04% | ★★★★★☆ |

Akeso | 32.58% | 54.53% | ★★★★★★ |

Cowell e Holdings | 31.82% | 35.43% | ★★★★★★ |

RemeGen | 26.30% | 52.19% | ★★★★★☆ |

Innovent Biologics | 22.24% | 59.39% | ★★★★★☆ |

Sichuan Kelun-Biotech Biopharmaceutical | 24.70% | 8.53% | ★★★★★☆ |

Biocytogen Pharmaceuticals (Beijing) | 21.53% | 109.17% | ★★★★★☆ |

Beijing Airdoc Technology | 37.47% | 93.35% | ★★★★★☆ |

Click here to see the full list of 45 stocks from our SEHK High Growth Tech and AI Stocks screener.

Here's a peek at a few of the choices from the screener.

Kuaishou Technology

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Kuaishou Technology, an investment holding company, offers live streaming, online marketing, and other services in the People’s Republic of China with a market cap of HK$206.73 billion.

Operations: Kuaishou Technology generates revenue primarily from domestic operations, amounting to CN¥117.32 billion, with a smaller contribution from overseas markets at CN¥3.57 billion. The company focuses on live streaming and online marketing services within China.

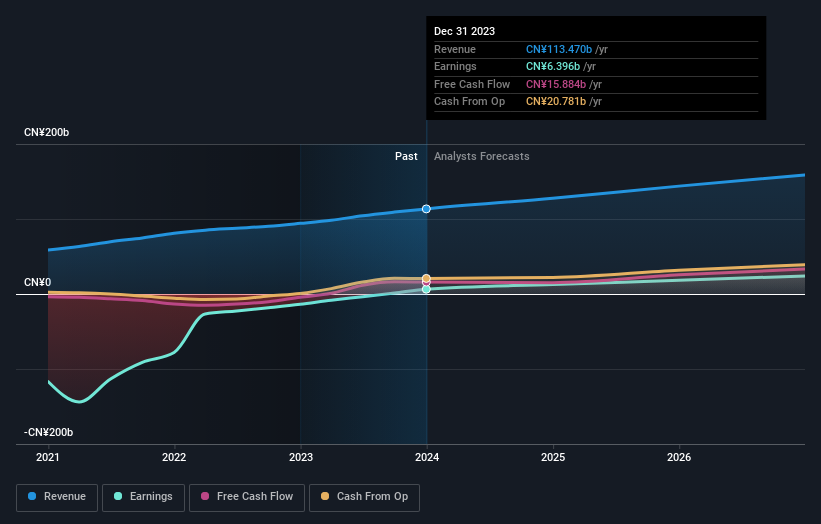

Kuaishou Technology, a player in the Interactive Media and Services sector, has demonstrated robust financial performance with a significant uptick in net income from CNY 1.48 billion to CNY 3.98 billion in Q2 2024 alone, reflecting an impressive growth trajectory. This surge is backed by a solid revenue increase of about 11.7% year-over-year for the same period, indicating strong market demand and effective business strategies. Notably, the company's commitment to innovation is evident from its R&D investments which have been pivotal in developing advanced AI technologies like Kling AI. These initiatives not only enhance product offerings but also secure a competitive edge by catering to dynamic consumer preferences and tech trends.

Unlock comprehensive insights into our analysis of Kuaishou Technology stock in this health report.

Understand Kuaishou Technology's track record by examining our Past report.

Tencent Holdings

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Tencent Holdings Limited is an investment holding company that provides value-added services, online advertising, fintech, and business services in China and internationally, with a market cap of HK$3.95 trillion.

Operations: Tencent Holdings Limited generates revenue primarily from value-added services (CN¥302.28 billion), fintech and business services (CN¥209.17 billion), and online advertising (CN¥111.89 billion). The company operates both in China and internationally, offering a diverse range of digital products and financial solutions.

Tencent Holdings Limited has demonstrated a substantial financial upswing in its recent earnings, with Q2 2024 net income soaring to CNY 47.63 billion from CNY 26.17 billion year-over-year, backed by a revenue jump to CNY 161.12 billion. This performance underscores an impressive growth trajectory with anticipated annual earnings growth of 12.8%. The firm's strategic focus on R&D is evident as it continues to innovate within the tech landscape, aligning with industry trends and enhancing its competitive edge in high-growth markets like AI and digital content. Recent presentations at the CITIC CLSA Investor's Forum highlight Tencent’s proactive strategy in navigating market dynamics, further solidifying its stature in tech innovation. With revenue expected to grow at 8.1% annually—outpacing the Hong Kong market average—Tencent is well-positioned to leverage its technological advancements and robust market presence for sustained growth amidst evolving digital consumption patterns.

Take a closer look at Tencent Holdings' potential here in our health report.

Review our historical performance report to gain insights into Tencent Holdings''s past performance.

Lenovo Group

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Lenovo Group Limited is an investment holding company that develops, manufactures, and markets technology products and services, with a market cap of HK$128.02 billion.

Operations: Lenovo Group Limited generates revenue primarily through its Intelligent Devices Group (IDG) at $45.76 billion, followed by the Infrastructure Solutions Group (ISG) at $10.17 billion, and the Solutions and Services Group (SSG) at $7.64 billion. The company focuses on technology products and services across these segments, driving its business operations.

Lenovo Group's recent strategic maneuvers underscore its adaptability and foresight in the high-growth tech sector, particularly through its innovations in hybrid cloud services and AI-driven solutions. With a robust increase in Q1 sales to $15.45 billion, up from $12.90 billion year-over-year, and a net income rise to $243 million from $176 million, Lenovo is reinforcing its market position. Notably, their R&D commitment is reflected in substantial investments which have facilitated pioneering developments such as the AD1 automotive domain controller for autonomous vehicles. This product leverages cutting-edge AI to deliver enhanced performance and safety features, setting new industry standards. Furthermore, Lenovo's collaboration with Databricks aims to streamline AI adoption across businesses enhancing data analytics capabilities significantly—showcasing Lenovo’s proactive approach towards integrating next-gen technology solutions that cater to evolving enterprise needs.

Click to explore a detailed breakdown of our findings in Lenovo Group's health report.

Examine Lenovo Group's past performance report to understand how it has performed in the past.

Where To Now?

Click this link to deep-dive into the 45 companies within our SEHK High Growth Tech and AI Stocks screener.

Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready To Venture Into Other Investment Styles?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SEHK:1024 SEHK:700 and SEHK:992.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com