Discovering Australia's Undiscovered Gems in September 2024

Over the last 7 days, the Australian market has remained flat, although it has risen 15% in the past 12 months with earnings forecast to grow by 12% annually. In this environment, identifying stocks with strong growth potential and solid fundamentals can be particularly rewarding.

Top 10 Undiscovered Gems With Strong Fundamentals In Australia

Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

Fiducian Group | NA | 9.94% | 6.48% | ★★★★★★ |

Sugar Terminals | NA | 3.14% | 3.53% | ★★★★★★ |

Bisalloy Steel Group | 0.95% | 10.27% | 24.14% | ★★★★★★ |

Lycopodium | NA | 17.22% | 33.85% | ★★★★★★ |

SKS Technologies Group | NA | 34.65% | 47.39% | ★★★★★★ |

BSP Financial Group | 7.53% | 7.31% | 4.10% | ★★★★★☆ |

Steamships Trading | 33.60% | 4.17% | 3.90% | ★★★★★☆ |

AMCIL | NA | 5.16% | 5.31% | ★★★★★☆ |

Hearts and Minds Investments | 1.00% | 18.81% | 20.95% | ★★★★☆☆ |

A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Emerald Resources

Simply Wall St Value Rating: ★★★★★☆

Overview: Emerald Resources NL focuses on the exploration and development of mineral reserves in Cambodia and Australia, with a market cap of A$2.56 billion.

Operations: Emerald Resources NL generates revenue primarily from mine operations, amounting to A$366.04 million.

Emerald Resources (EMR) has shown impressive growth, with earnings increasing by 41.9% over the past year, significantly outpacing the Metals and Mining industry’s -0.3%. The company reported A$371.07 million in sales for FY2024, up from A$299.48 million last year, and net income rose to A$84.27 million from A$59.36 million. Despite a debt-to-equity ratio increase to 8.5% over five years, EMR's interest payments are well covered by EBIT at 18.6x coverage, indicating robust financial health.

Unlock comprehensive insights into our analysis of Emerald Resources stock in this health report.

Evaluate Emerald Resources' historical performance by accessing our past performance report.

RPMGlobal Holdings

Simply Wall St Value Rating: ★★★★★★

Overview: RPMGlobal Holdings Limited develops and provides mining software solutions across Australia, Asia, the Americas, Africa, and Europe with a market cap of A$620.01 million.

Operations: RPMGlobal Holdings generates revenue primarily from its Advisory segment (A$31.41 million) and Software segment (A$72.67 million), with a combined total of A$104.08 million.

RPMGlobal Holdings, a standout in the Australian software sector, has seen earnings growth of 134.6% over the past year, outpacing its industry peers' 6.8%. The company reported A$104.19 million in revenue for FY2024, up from A$91.56 million last year, with net income rising to A$8.66 million from A$3.69 million previously. Recently added to both the S&P/ASX Small Ordinaries and S&P/ASX 300 Indexes, RPMGlobal showcases promising potential for future growth and stability in its market segment.

Take a closer look at RPMGlobal Holdings' potential here in our health report.

Assess RPMGlobal Holdings' past performance with our detailed historical performance reports.

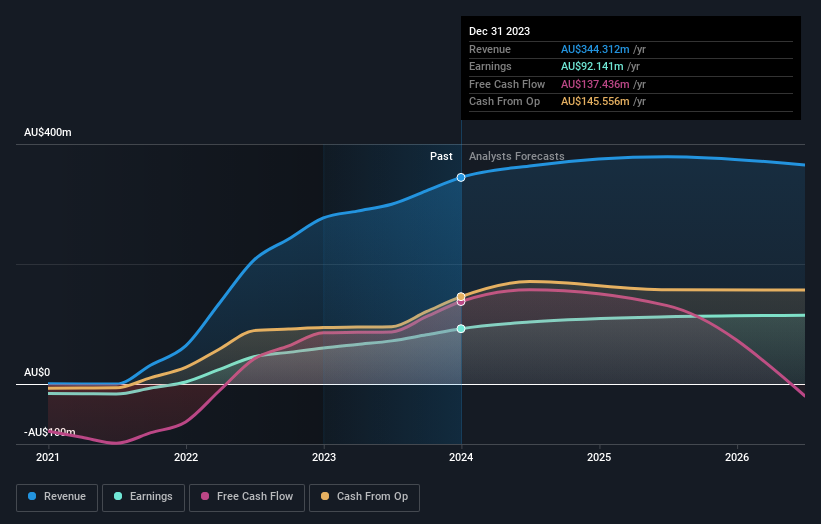

Westgold Resources

Simply Wall St Value Rating: ★★★★★★

Overview: Westgold Resources Limited focuses on the exploration, operation, development, mining, and treatment of gold and other assets primarily in Western Australia, with a market cap of A$2.57 billion.

Operations: Westgold Resources Limited generates revenue primarily from its Bryah and Murchison segments, contributing A$183.25 million and A$533.23 million respectively.

Westgold Resources, a small cap miner, has seen remarkable growth with earnings up 852% over the past year and forecasted to grow 37.77% annually. Recently added to the S&P/ASX 200 Index, it reported net income of A$95.23 million for FY24 compared to A$10 million last year. The company is debt-free and free cash flow positive, but shareholders experienced substantial dilution in the past year. Production guidance for FY25 increased significantly from previous years.

Seize The Opportunity

Click here to access our complete index of 57 ASX Undiscovered Gems With Strong Fundamentals.

Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Looking For Alternative Opportunities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include ASX:EMR ASX:RUL and ASX:WGX.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com