The Best Stocks to Invest $50,000 in Right Now

I often like to say that investing is like cooking: Having a fantastic recipe doesn't guarantee success, but it's certainly a good start.

With that in mind, let's take a shot at putting together an investment recipe -- a hypothetical $50,000 portfolio.

Here's what I have in mind.

Walmart

To begin, I'm allocating $20,000, or 40% of my hypothetical portfolio, to Walmart (NYSE: WMT).

While researching an article about the largest companies in 2009, I discovered that only one of the top five from that year (by revenue) remains in the top five today. Spoiler alert: It's Walmart.

Clearly, the company has staying power. Much has changed about the retail landscape over the last 15 years with the rise in e-commerce. Yet, Walmart hasn't just survived, it has thrived.

Over the last 12 months, the company generated more than $665 billion in sales. That's first among all American companies. Since 2009, the company has increased its sales by 65%. Much of that growth is due to Walmart expanding its focus to include e-commerce.

For example, in its most recent quarter (the three months ending on July 31), the company reported $115 billion in U.S. sales. Nearly $19 billion, or about 17% of that, came from online orders. It has now reported e-commerce growth of 20% or higher in five of its last six quarters.

In short, Walmart stands a decent chance to be one of the five largest American companies by revenue in another 15 years, given its rapid e-commerce growth. That's great news for Walmart -- and for prospective investors.

Duolingo

Next up, I'm allocating $5,000, or 10% of my hypothetical portfolio, to Duolingo (NASDAQ: DUOL).

When it comes to Duolingo, I'm taking a page from one of my investing heroes, Peter Lynch, former manager of the Fidelity Magellan mutual fund. He advised investors to "buy what you know." And in the case of Duolingo, I know quite a bit.

For those who don't know, here's a quick rundown of the company: It operates a language-learning app, downloadable on smartphones and other devices. Users can then start mastering a language for free.

But this is no ordinary app. It's highly addictive, thanks to its smart design and "gamification" features, which feel more like playing a video game than conjugating verbs and memorizing vocabulary.

As a result, Duolingo is a hit, and it's racking up tons of new users and subscribers.

In its most recent quarter (the three months ending on June 30), the company surpassed 100 million monthly active users. Its total subscribers grew to 8 million, up 52% from a year earlier.

Those impressive user figures are contributing to fantastic financials, too. Revenue grew 41% year over year to $178 million, and net income rose to $24 million -- more than six times what it was in the same quarter one year ago. And analysts expect the company to generate about $950 million in revenue next year, up about 29% from this year.

In summary, Duolingo has lots of upside potential. By allocating 10% of my hypothetical portfolio to this highflier, I'm adding some spice to my investment recipe.

Microsoft

Lastly, I'm allocating $25,000, or 50% of my hypothetical portfolio, to Microsoft (NASDAQ: MSFT).

The reason I'm investing so much in Microsoft is simple: It's a great company with fantastic leadership in a growing industry.

Everyone knows Microsoft. It's been an iconic American company for decades, and many of its products are legendary. But in addition to its famous software applications like Office and Windows, the company also has large unrelated business segments like gaming and cloud services.

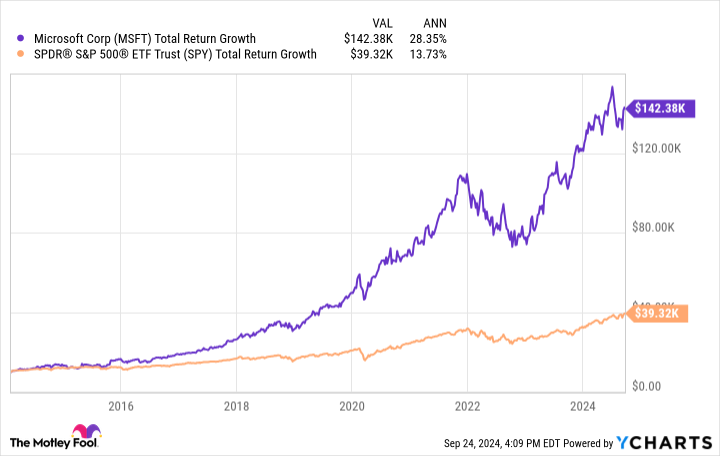

As for its leadership, CEO Satya Nadella has now been at the helm for over a decade, and the record is clear: He's a winner. The company's stock has soared by more than 1,300% over that time, for a compound annual growth rate of 28.4% -- which more than doubles the return from the S&P 500 over the same period.

MSFT total return level; data by YCharts.

Yet, what's most exciting about Microsoft is its future. The company is a leader in artificial intelligence (AI). Its key partnership with ChatGPT maker OpenAI has already seen it integrate AI features into its iconic software suite, with more probably on the way.

To close, by allocating half of my $50,000 portfolio to Microsoft, I'm confident my recipe has a solid base with one of the world's largest and best-run companies. Moreover, it's a stock that has significantly outperformed the benchmark S&P 500 for more than a decade.

Should you invest $1,000 in Microsoft right now?

Before you buy stock in Microsoft, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Microsoft wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $743,952!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 23, 2024

Jake Lerch has positions in Duolingo. The Motley Fool has positions in and recommends Duolingo, Microsoft, and Walmart. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

The Best Stocks to Invest $50,000 in Right Now was originally published by The Motley Fool