3 ASX Growth Stocks With High Insider Ownership Expecting Up To 106% Earnings Growth

The Australian market has seen a positive trend, rising 2.2% over the last week and climbing 11% in the past year, with earnings expected to grow by 13% annually over the next few years. In this favorable environment, stocks with high insider ownership and significant growth potential can be particularly attractive to investors.

Top 10 Growth Companies With High Insider Ownership In Australia

Name | Insider Ownership | Earnings Growth |

Hartshead Resources (ASX:HHR) | 13.9% | 102.6% |

Cettire (ASX:CTT) | 28.7% | 26.7% |

Acrux (ASX:ACR) | 14.6% | 115.6% |

Clinuvel Pharmaceuticals (ASX:CUV) | 13.6% | 26.8% |

Liontown Resources (ASX:LTR) | 16.4% | 69.7% |

Catalyst Metals (ASX:CYL) | 17.5% | 75.7% |

Hillgrove Resources (ASX:HGO) | 10.4% | 49.4% |

Adveritas (ASX:AV1) | 21.1% | 103.9% |

Plenti Group (ASX:PLT) | 12.8% | 106.4% |

Change Financial (ASX:CCA) | 26.6% | 77.9% |

Below we spotlight a couple of our favorites from our exclusive screener.

Emerald Resources

Simply Wall St Growth Rating: ★★★★★☆

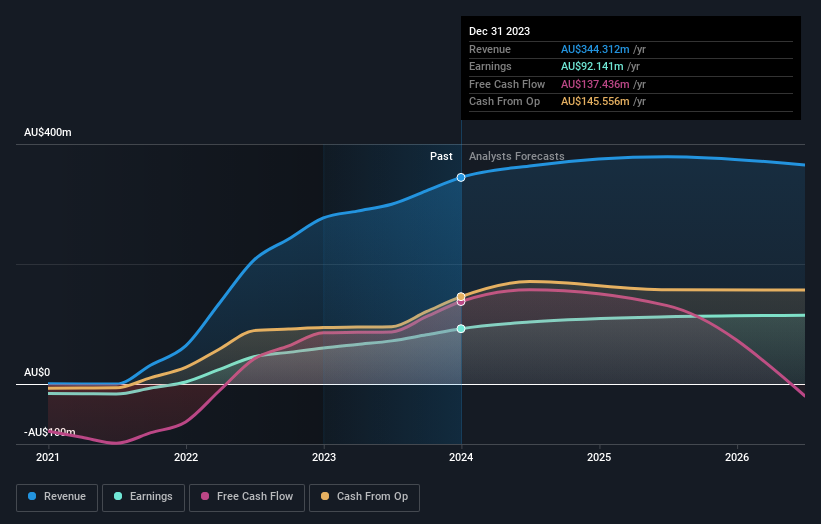

Overview: Emerald Resources NL focuses on the exploration and development of mineral reserves in Cambodia and Australia, with a market cap of A$2.62 billion.

Operations: Emerald Resources NL generates revenue primarily from mine operations, totaling A$339.32 million.

Insider Ownership: 18.4%

Earnings Growth Forecast: 20.1% p.a.

Emerald Resources has demonstrated strong growth, with earnings increasing by 53.4% over the past year and forecasted to grow by 20.14% annually. The company trades at a significant discount, approximately 56.9% below its estimated fair value. Revenue is expected to rise by 18.5% per year, outpacing the Australian market's growth rate of 5.4%. Despite past shareholder dilution, no substantial insider trading has occurred recently, indicating confidence in future performance.

Ora Banda Mining

Simply Wall St Growth Rating: ★★★★★★

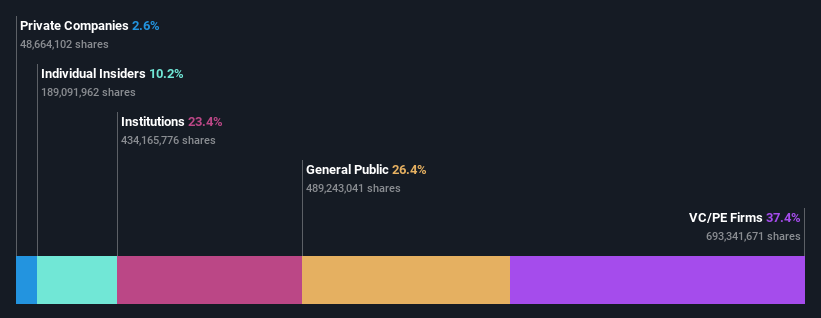

Overview: Ora Banda Mining Limited (ASX:OBM) is an Australian company involved in the exploration, operation, and development of mineral properties with a market cap of A$902.56 million.

Operations: Ora Banda Mining's primary revenue segment is Gold Mining, generating A$166.66 million.

Insider Ownership: 10.2%

Earnings Growth Forecast: 106.8% p.a.

Ora Banda Mining is forecast to achieve profitability within three years, with revenue expected to grow at 46.4% annually, significantly outpacing the Australian market's 5.4%. The stock trades at a substantial discount, approximately 94.5% below its estimated fair value, and earnings are projected to increase by 106.84% per year. Recent developments include the appointment of geologist Kathryn Cutler as an independent Non-executive Director, enhancing the company's exploration and resource development capabilities.

Technology One

Simply Wall St Growth Rating: ★★★★☆☆

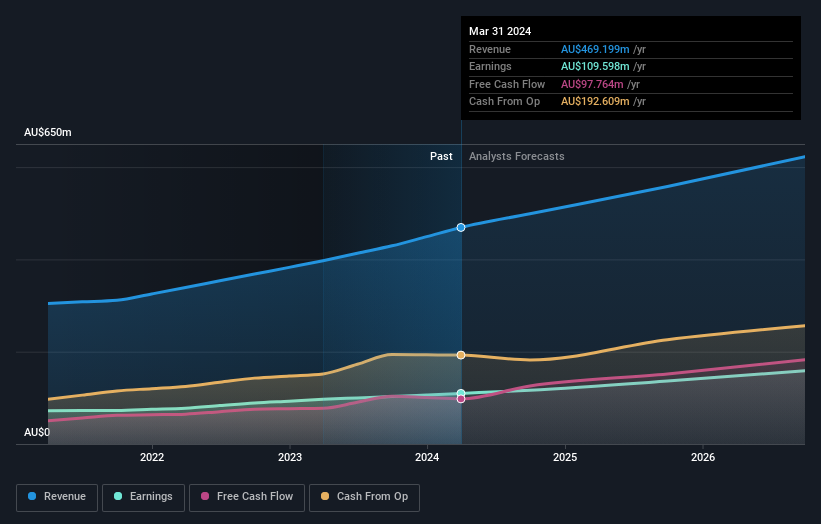

Overview: Technology One Limited develops, markets, sells, implements, and supports integrated enterprise business software solutions in Australia and internationally with a market cap of A$7.37 billion.

Operations: The company's revenue segments consist of A$317.24 million from Software, A$83.83 million from Corporate, and A$68.13 million from Consulting.

Insider Ownership: 12.3%

Earnings Growth Forecast: 14.8% p.a.

Technology One has demonstrated solid growth, with recent half-year revenue increasing to A$240.83 million from A$201.01 million and net income rising to A$48 million from A$41.28 million year-over-year. Earnings per share also saw an uptick. The company appointed Paul Robson as a Non-Executive Director, bringing extensive SaaS experience that aligns with its strategic goals. Forecasted earnings growth of 14.8% annually outpaces the Australian market, highlighting its potential as a growth-focused entity with substantial insider ownership.

Make It Happen

Discover the full array of 91 Fast Growing ASX Companies With High Insider Ownership right here.

Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Want To Explore Some Alternatives?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include ASX:EMR ASX:OBM and ASX:TNE.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com